Argentina’s Inflation Hits 287.9% in March, Central Bank Cuts Rates

Argentina's inflation rate surged to 287.9% annually in March, a slight uptick from February's 276%, as reported by the country's statistical agency, Indec.

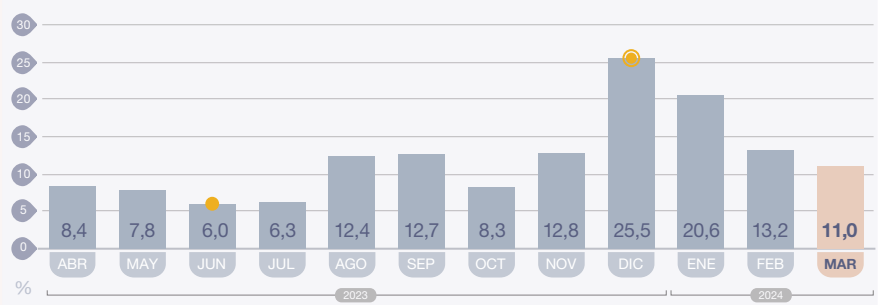

On a monthly basis, the Consumer Price Index (IPC) increased by 11.0%, a moderation from February’s 13.2% rise, prompting the central bank to slash interest rates earlier in the week.

The recent inflationary crisis saw its peak in December, triggered by the government’s peso devaluation and the initial subsidy reductions, leading to a subsequent decline over the past three months.

March witnessed direct impacts on consumer spending, causing Argentinians to pull back on major purchases, consequently contributing to a significant downturn in manufacturing, confirmed by both local sources and official statistics.

Indec highlighted specific sectors driving the price hikes, with education experiencing the highest increase (52.7%) due to rising academic fees, followed by communication (15.9%) and housing, water, electricity, gas, and other fuels (13.3%).

READ MORE: Falling Inflation Could Lead to Fed Rate Cut, Boost Stock Market – Tom Lee

Food and non-alcoholic beverages recorded the highest overall incidence across regions, with notable increases in meat, dairy products, vegetables, and bread.

Despite the persistent high inflation, Argentina’s central bank decided to lower interest rates to 70% from 80%, citing a slowdown in inflationary pressures since December 2023. The bank emphasized the importance of monitoring core inflation indicators amidst adjustments to regulated tariffs and subsidy withdrawals by the new government.