Banking Giant JPMorgan Reveals Bitcoin ETF Holdings

JPMorgan Chase, the largest US bank, has revealed its holdings in Bitcoin exchange-traded funds (ETFs) in a recent filing.

While the bank’s cumulative Bitcoin ETF holdings are currently small at $1.2 million, this signals a growing acceptance of Bitcoin.

BlackRock’s Robert Mitchnick recently mentioned that major financial institutions, including pension funds, were gearing up to explore Bitcoin ETFs. Mitchnick downplayed the significance of the recent slowdown in ETF inflows, emphasizing the continued strong demand for Bitcoin exposure. Wells Fargo, another major US bank, also disclosed its Bitcoin ETF holdings in a recent filing.

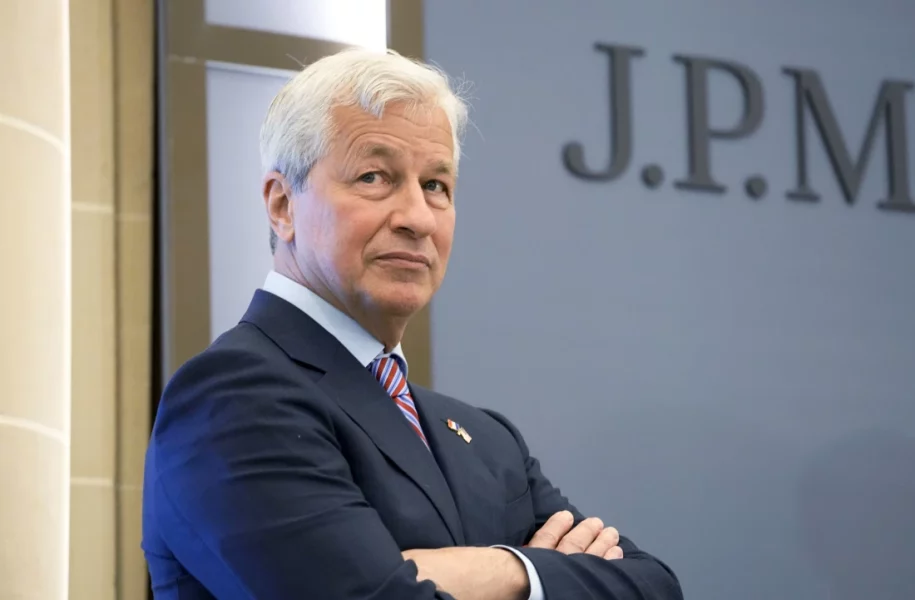

Meanwhile, JPMorgan CEO Jamie Dimon remains critical of Bitcoin. In December, he suggested that the US government should consider shutting down the largest cryptocurrency. Recently, he labeled Bitcoin as a “Ponzi scheme.” Despite Dimon’s stance, JPMorgan launched a passively managed Bitcoin fund for its wealth clients in 2021. Additionally, the bank was named among the authorized participants for BlackRock’s record-breaking Bitcoin ETF last year.

READ MORE: Investment Giant Susquehanna Allocates $1 Billion to Bitcoin ETFs

In terms of ETF flows, Bitcoin ETFs experienced mixed results on Thursday. Grayscale’s GBTC saw significant outflows of over $43 million, while BlackRock’s ETFs saw relatively modest inflows of $14.2 million, which did not fully offset the outflows.

Despite the negative ETF data, Bitcoin managed to rebound to the $63,000 level before experiencing a subsequent decline.