Bernstein Analysts Predict Bitcoin to Hit $200K by 2025

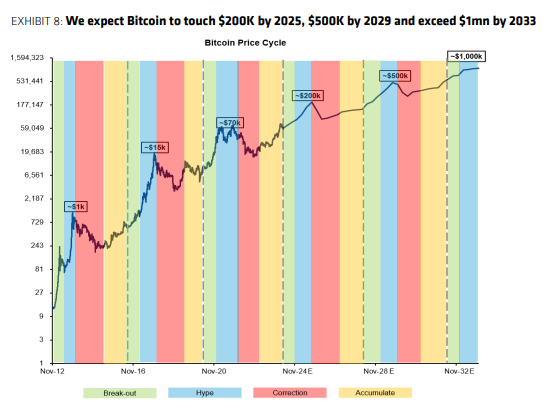

Bernstein analysts have risen their Bitcoin price target to $200,000 by the end of 2025, up from $150,000.

This new number comes as there are expectations on increased demand for Bitcoin ETFs, managed by financial giants such as BlackRock, Fidelity, and Franklin Templeton.

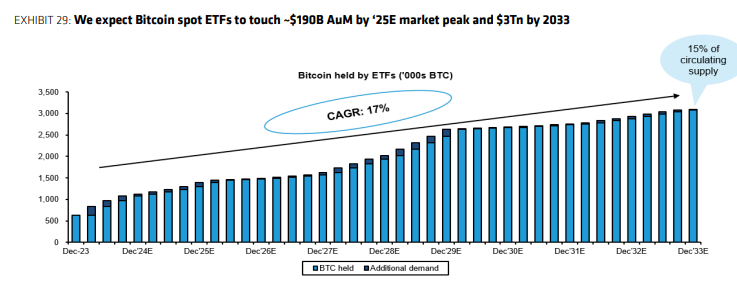

The analysts, Gautam Chhugani and Mahika Sapra, attribute this demand to U.S. regulated ETFs, which have substantially reinforced Bitcoin’s attractiveness among traditional investors and attracted about $15 billion in new funds. They predict Bitcoin ETFs will account for about 7% of Bitcoin in circulation by 2025 and 15% by 2033.

Bitcoin’s scarcity is the main driving force in Bernstein’s opinion, especially since the last halving in April resulted in the production of only 450 BTC instead of a previous daily output of 900 BTC.

‘The halving effect’ has a drastic impact on the selling pressures miners usually generate as well as the demand hike. Thus, the cumulative effect of this would be exponential price growth.

READ MORE: Trump Holds Talks with Bitcoin Miners, Backs Crypto Sector

Historically, Bitcoin has risen above its marginal cost of production during bull times several times. Bernstein expects Bitcoin to reach 1.5x its marginal production cost, indicating a peak of $200,000 by mid-2025 for the 2024-2027 cycle. They also project Bitcoin might reach $500,000 by 2029 and $1 million by 2033.

At the time of writing, Bitcoin is trading at around $67,250.

Bernstein has recently initiated its coverage of MicroStrategy, a key corporate Bitcoin owner, with an over-perform rating and a $2,890 price target by 2025. MicroStrategy, which holds 214,400 BTC worth over $14 billion, has this exposure due to its investment strategy. The firm is presently planning to roll out a $700 million convertible note offering to secure more Bitcoin and for general purposes in tandem with the redemption of $650 million in 2025 notes.

The analysts are of the opinion that MicroStrategy aims at lessening its liquidation risks with this strategy and also at the same time drawing on the potential of Bitcoin’s upside. They estimate that by the end of 2025, MicroStrategy could have 1.5% of Bitcoin’s supply of their own.