Binance Soars Ahead in the Crypto Race with Record Trading Volumes

A recent report from CryptoCompare highlights that Binance, the world’s largest centralized crypto exchange, has seen a significant increase in its market share.

According to the data from CryptoCompare, Binance’s market share rose from 59.4% in January to 61.8% in February. The report also reveals that Binance’s spot volumes have reached an all-time high market share of $504 billion, which represents a 13.7% increase.

Binance continues to dominate the market

In comparison, Coinbase, the second-largest crypto exchange, saw $39.9 billion traded in February, marking a 29% decrease from the previous month. Meanwhile, Kraken, the third-largest exchange, experienced a decrease of 11% with $19.3 billion traded in February.

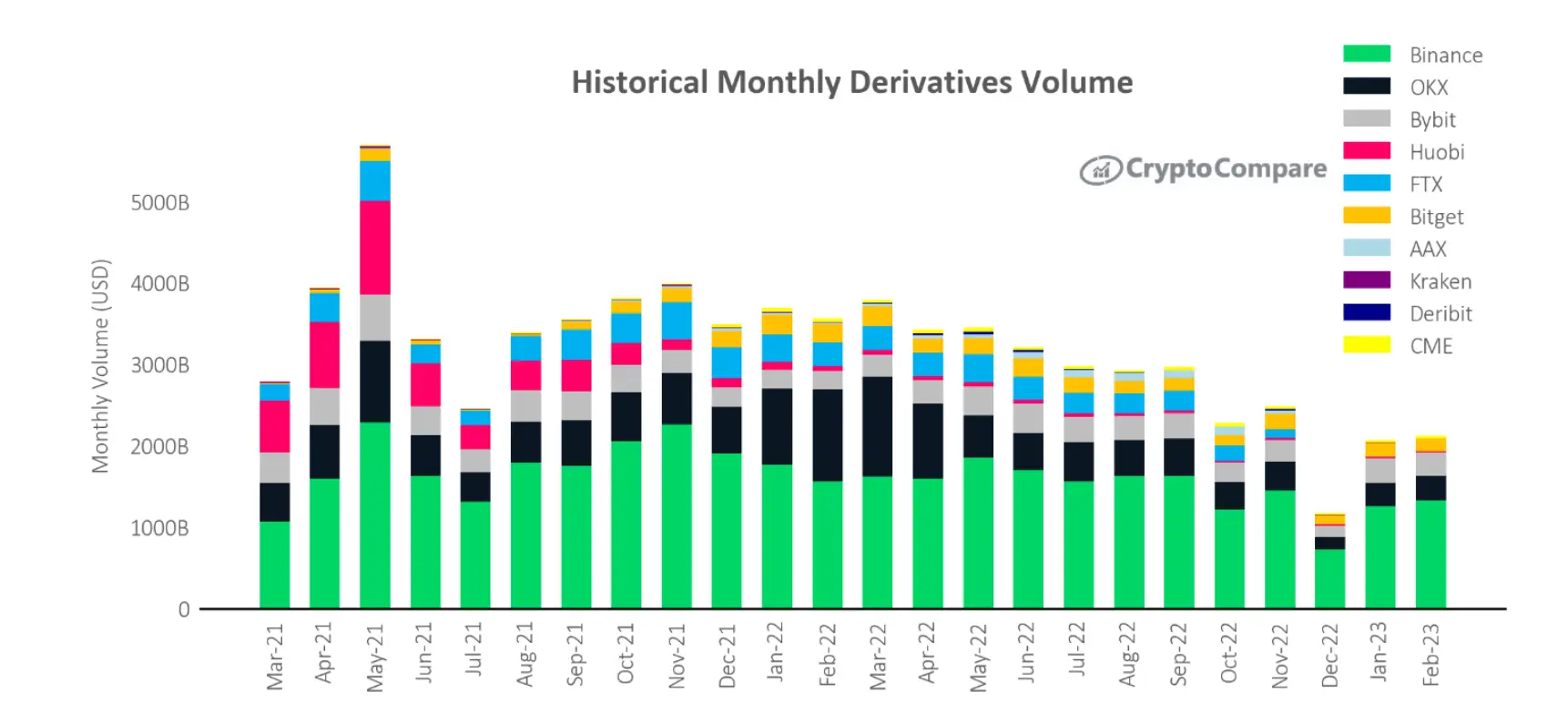

Binance’s market share across derivative exchanges has also grown to 62.9%, the highest monthly market share ever recorded for the exchange. OKX and Bybit followed with 14% and 13.3% market share, respectively.

Binance’s introduction of zero-fee Bitcoin trading has been identified as a significant contributing factor to its dominance.

Eliminating fees on BTC trading had a substantial impact on the overall dominance of spot trading volume.

Binance’s global expansion efforts have also helped to enhance its dominance in trading volume. Despite the bear market, Binance has intensified its efforts to expand globally, successfully registering as a Financial Service Provider in New Zealand and France, Spain, and Italy markets like South Korea and Japan.

The influx of new traders to the exchange due to this expansion has further strengthened Binance’s dominance in trading volume, according to analysts.

Binance regulatory scrutiny

However, Binance has also been subject to increasing regulatory scrutiny from regulators in the US and other countries. This scrutiny has caused fear, uncertainty, and doubt to surround Binance. This caused Binance to scale back some commitments, citing negative industry perspectives regarding regulatory clarity and adoption in the US.

READ MORE: Why did Bitcoin Drop Under $20,000?

In the meantime crypto traders are quickly moving away from Binance’s stablecoin BUSD, leading to a 60% decrease in supply since mid-February. This decrease in supply has resulted from the US Securities and Exchange Commission’s (SEC) action against the issuer of the Binance stablecoin, Paxos, classifying it as a security.

Conclusion

During the month of February, cryptocurrency exchanges experienced a 4.01% surge in trading activity across both spot and derivative markets, a trend that aligns with the current marginal upswing in BTC and ETH returns.

This increase in volume can also be attributed to the heightened volatility and risk-taking that has characterized crypto markets since the start of 2023, a noticeable difference from the end of the previous year.

Nevertheless, it’s worth noting that this growth should be viewed in light of the fact that volumes still remain significantly lower, with a 71.0% decline from the all-time highs recorded in May 2021.