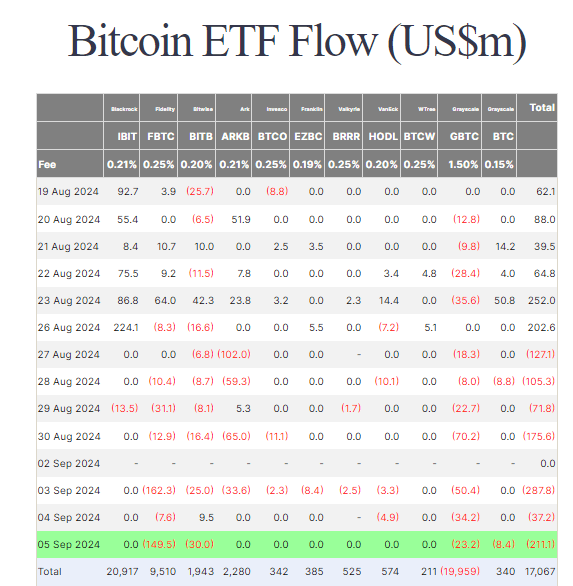

Bitcoin ETFs See $211 Million in Outflows as Spot Price Drops

On September 5, Bitcoin ETFs experienced a substantial $211.1 million in withdrawals, continuing a trend of significant outflows.

This marks the seventh consecutive day of such declines, with no fresh investments reported by ETF issuers.

The largest losses were recorded by Fidelity’s FBTC, which saw a $149.5 million decrease. Other notable drops included Bitwise’s BITB at $30 million, Grayscale’s GBTC with $23.2 million, and various BTC ETFs collectively losing $8.4 million.

Over the past week, Bitcoin ETFs have seen over $1 billion exit, reducing net inflows to $17.1 billion. Bitcoin’s value has decreased from roughly $62,000 to $55,500 during this period.

READ MORE: Bitfinex Predicts Bitcoin Could Drop to $40,000 Amid September Rate Cut Uncertainty

Ethereum ETFs saw minimal activity with only a $0.2 million outflow. The primary movement occurred in Grayscale’s products, where ETHE experienced a $7.4 million drop, while other ETH ETFs recorded a $7.2 million increase.

Total outflows from Ethereum ETFs have now reached $562.5 million, and Ethereum’s annual performance remains negative.