Bitcoin: Institutional Investors Short BTC – Here’s Why

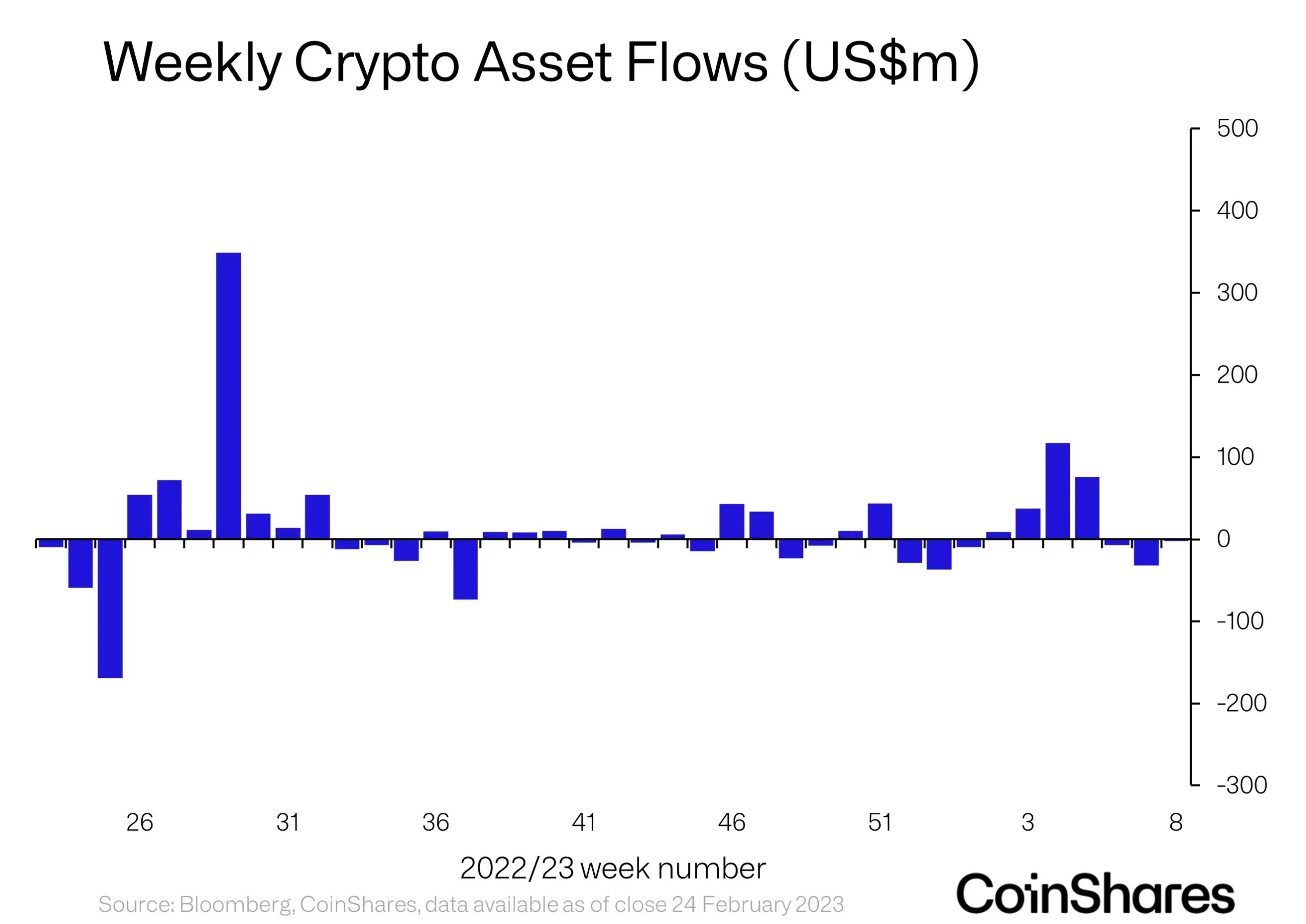

Institutional digital asset investment products experienced minor outflows last week, with large inflows going into short products.

According to the latest Digital Asset Fund Flows Weekly Report by CoinShares, institutional digital asset investment products witnessed minor outflows last week.

On the other hand, short investment products received significant inflows.

Digital asset investment products saw outflows amounting to US$2m; however, short investment products, designed to benefit from falling prices, experienced the largest inflows.

Bitcoin products, in particular, suffered the heaviest hit of outflows amounting to $11.7 million. Conversely, short-Bitcoin products saw substantial inflows of $9.9 million.

CoinShares believes that nervousness among US investors, triggered by the recent stronger-than-expected macro data releases and regulatory crackdowns in the US, has led to this negative sentiment.

READ MORE: Venture Capitalist Predicts 2,200% Gains for This Altcoin

CoinShares also reported that altcoins experienced mixed inflows and outflows, with Cardano (ADA), Solana (SOL), and Polygon (MATIC) institutional investment products seeing inflows of $0.4, $0.5, and $0.6 million, respectively.

However, Ethereum (ETH), Litecoin (LTC), and multi-asset investment vehicles suffered outflows.