Bitcoin Outperforms Traditional Assets: A Look at its Recent Surge and Market Impact

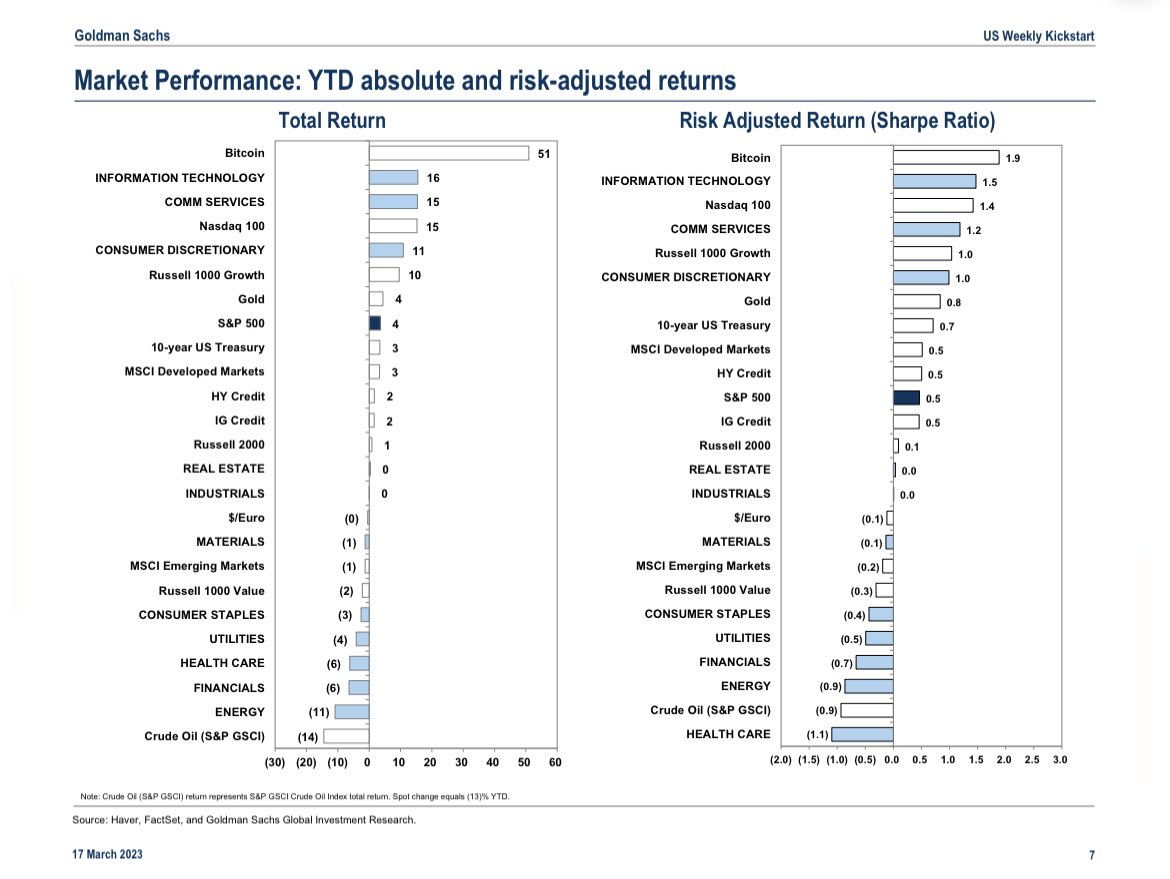

According to recent data from Goldman Sachs, Bitcoin has surpassed traditional investment assets and sectors such as gold and technology in both year-to-date (YTD) absolute returns and risk-adjusted performance.

In terms of absolute returns, the leading cryptocurrency has gained 51% YTD, outperforming various sectors like communication services, consumer discretionary, Russell 1000 Growth, gold, and the S&P 500. Meanwhile, energy and crude oil have seen declines.

However, the market’s floor will depend on OPEC+ and the US. The bellwether coin has also demonstrated strong performance in risk-adjusted returns, with a score of 1.9 on the Sharpe Ratio, higher than other sectors such as information technology, Nasdaq, and healthcare.

Bitcoin‘s recent price surge has been linked to the likelihood of the US Federal Reserve changing its hawkish monetary policy.

The cryptocurrency has risen by 35% since March 10, when regulators shut down Silicon Valley Bank.

Despite market analysts warning of a possible correction, Bitcoin’s rebound has been stronger than that of Wall Street stocks, gaining the attention of investors.

READ MORE: Bitcoin Facing Significant Pressure Despite Recent Surge

Terra, FTX, and Celsis 3AC’s implosion and global monetary tightening damaged investor confidence in cryptocurrencies in 2022. Bitcoin experienced a massive correction, but it ended the week with a 34 gain, the best since January 2021, amid the ongoing banking crisis.

This indicates a narrative shift in the perception of the largest cryptocurrency.

Desperate cryptocurrency investors have welcomed the crypto rally during the ongoing banking crisis after a brutal bear market, and some have suggested that there is a change in how Bitcoin is perceived.

Nevertheless, the value of Bitcoin is still largely affected by changes in inflation rates and decisions made by the Federal Reserve regarding interest rates.