Bitcoin: The Ultimate Inflation Hedge?

Bitcoin has a low inflation rate compared to the United States dollar, making it an attractive option as a hedge against economic uncertainty.

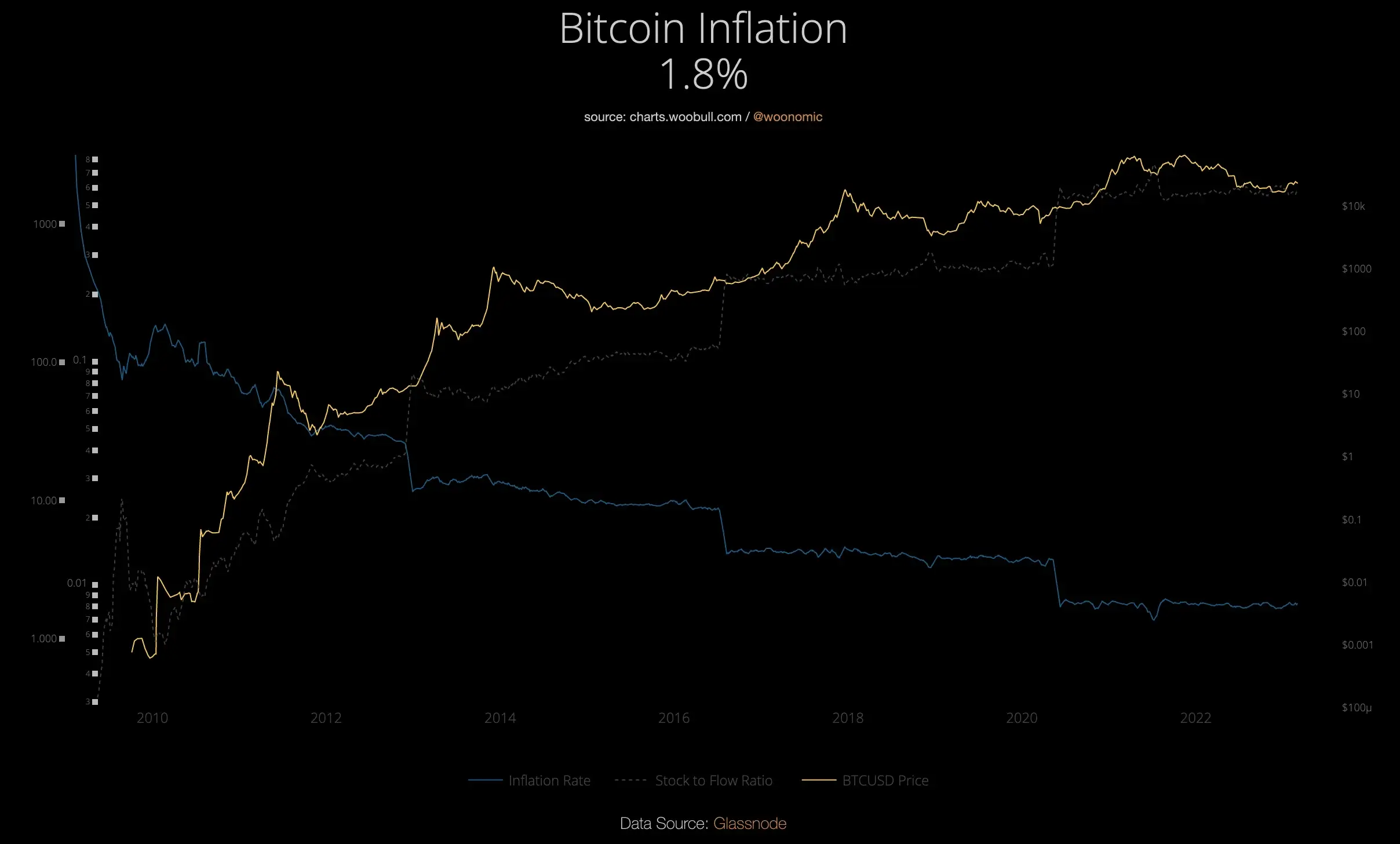

As of March 4, 2023, the inflation rate is 1.80%. This is due to Bitcoin’s fixed supply of 21 million BTCs, which reduces its inflation rate after every four years during the halving event. In contrast, the annual inflation rate of the U.S. dollar is 6.4%, which is 3.57 times higher than Bitcoin.

Bitcoin‘s deflationary model is responsible for its decreasing inflation rate. This model reduces the inflation rate post-halving events every four years.

The reward system for miners determines the inflation rate, with each halving event halving the Bitcoin rewards for miners.

This reduction means that the number of Bitcoins produced through mining is also halved, with the next event estimated to occur in May 2024.

On the other hand, the U.S. dollar inflation rate is likely to increase as its value decreases due to excessive printing and the diminishing purchasing power of each dollar. Bitcoin’s decentralization nature allows it to circumvent most political and economic risks linked with the U.S. dollar, contributing to its lower inflation rate.

READ MORE: Bitcoin: Expert Warns of Potential Downside as Fed Raises Interest Rates

Due to their contrasting inflation rates, there is a debate over the best investment option and hedge between Bitcoin and the U.S. dollar.

Bitcoin proponents argue that BTC is the ideal asset to protect against inflation, but its price has yet to reflect this amid rising inflation and interest rate hikes.

While Bitcoin’s 2023 rally has been cut short, with the crypto facing threats of retesting lows below $20,000, it remains an attractive option as a hedge against economic uncertainty. By press time, BTC was trading at $22,382.