Crypto Investment Firm Galaxy Digital Goes All-In on Bitcoin & Ethereum

Crypto Investment firm Galaxy Digital has made noteworthy moves indicating a positive stance in the crypto space.

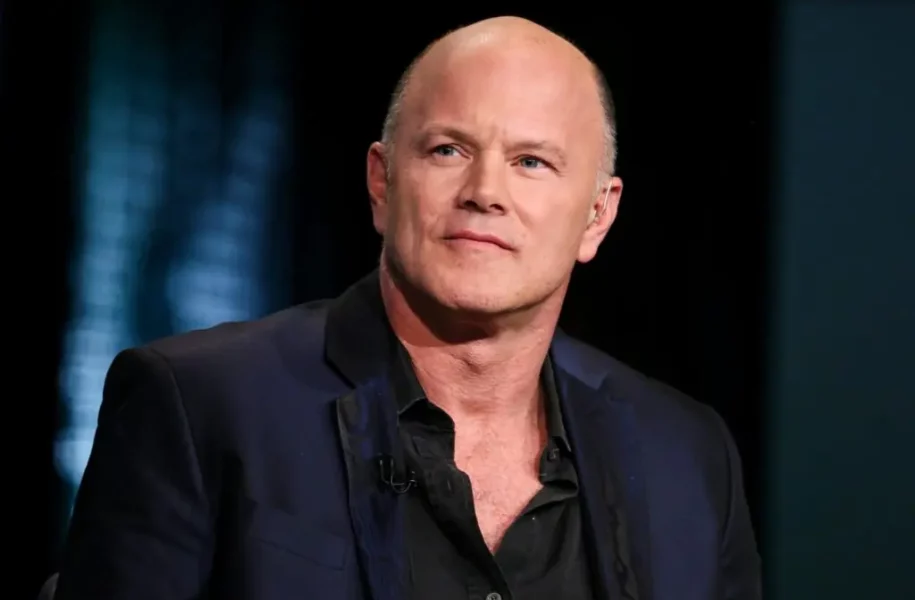

The firm’s CEO, Mike Novogratz, holds a strong conviction in the possibility of the U.S. SEC’s approval of a spot Bitcoin ETF within the current year. Insights gleaned from on-chain data platforms reveal Galaxy Digital’s significant involvement in Bitcoin and Ethereum via decentralized lending platforms such as Aave and Compound.

Galaxy Digital’s Strategic Ventures in Bitcoin, Ethereum, Aave, and Compound Reports on October 28 by Lookonchain highlighted Galaxy Digital’s substantial long-term positions in Bitcoin (BTC) and Ethereum (ETH) using platforms like Aave and Compound.

Galaxy Digital has made substantial investments in $BTC and $ETH on Aave and Compound.

Lookonchain referenced data from Debank, shedding light on Galaxy Digital’s deposits of 4,168 WBTC (valued at $142 million) and 16,000 ETH (valued at $28.6 million) within Aave and Compound, while also borrowing 71.6 million USDT and 21.9 million USDC.

By expanding its portfolio in Bitcoin and Ethereum and utilizing Aave and Compound’s services, Galaxy Digital’s moves signal a bullish outlook for the DeFi sector.

Consequently, both AAVE and COMP prices experienced increases of 5% and 3%, respectively, in the past 24 hours. Notably, within the recent crypto market upsurge driven by the expectations surrounding a Bitcoin ETF, both Aave and Compound prices surged by over 20% and 12%, respectively.

READ MORE: Dark Web Bitcoin Shuffle Sparks Regulator Crackdown

Mike Novogratz remains optimistic, highlighting promising talks between Bitcoin ETF issuers and the U.S. SEC, signaling a possible approval of a spot Bitcoin ETF in 2023. According to Novogratz, it’s now a question of timing rather than uncertainty.

Potential Upsurge in Bitcoin and Ethereum Values Based on recent research by Galaxy Digital, the issuance of a spot Bitcoin ETF could potentially attract about $14.4 billion in the first year.

Moreover, Galaxy Digital predicts a potential uptick of nearly 74.1% in BTC’s value in the initial year post the launch of a spot Bitcoin ETF in the United States.