Ethereum Staking Booms Despite Market Volatility, But Over Half Remain Underwater

The quantity of Ethereum that has been staked is on the rise, but more than half of it is still at a loss despite the recent surge in the ETH price.

According to research shared by analysts on Feb. 18, a significant percentage of Ethereum that was staked is underwater. The data shows that 60% of all staked ETH was secured at a price of $1,600 or above, while the remaining 40% that was staked at lower prices is profitable.

Over 2 million ETH were staked at rates between $500 and $700 when the Beacon Chain was released in December 2020, and the asset was priced at around $600. Although more than half of Ethereum stakers are at a loss may not sound encouraging, the situation has improved since last year when the price of ETH fell as low as $1,000, causing more than 80% of staked ETH to be underwater.

Staked ETH

Currently, 16.7 million ETH is staked, worth around $28.2 billion at current rates, accounting for 13.8% of the total supply. Since the Merge in September 2022, this supply has shrunk by roughly 29,192 ETH or $49.2 million. Furthermore, the supply of ETH is presently deflationary, with a decline of about a quarter of a percent per year.

The upcoming Shanghai upgrade will enable the gradual release of staked Ethereum by the end of March, with analysts predicting a significant boost for liquid staking platforms that offer better yield opportunities than staking directly.

READ MORE: Bitcoin Positioned for “Big Move” – Here’s Why

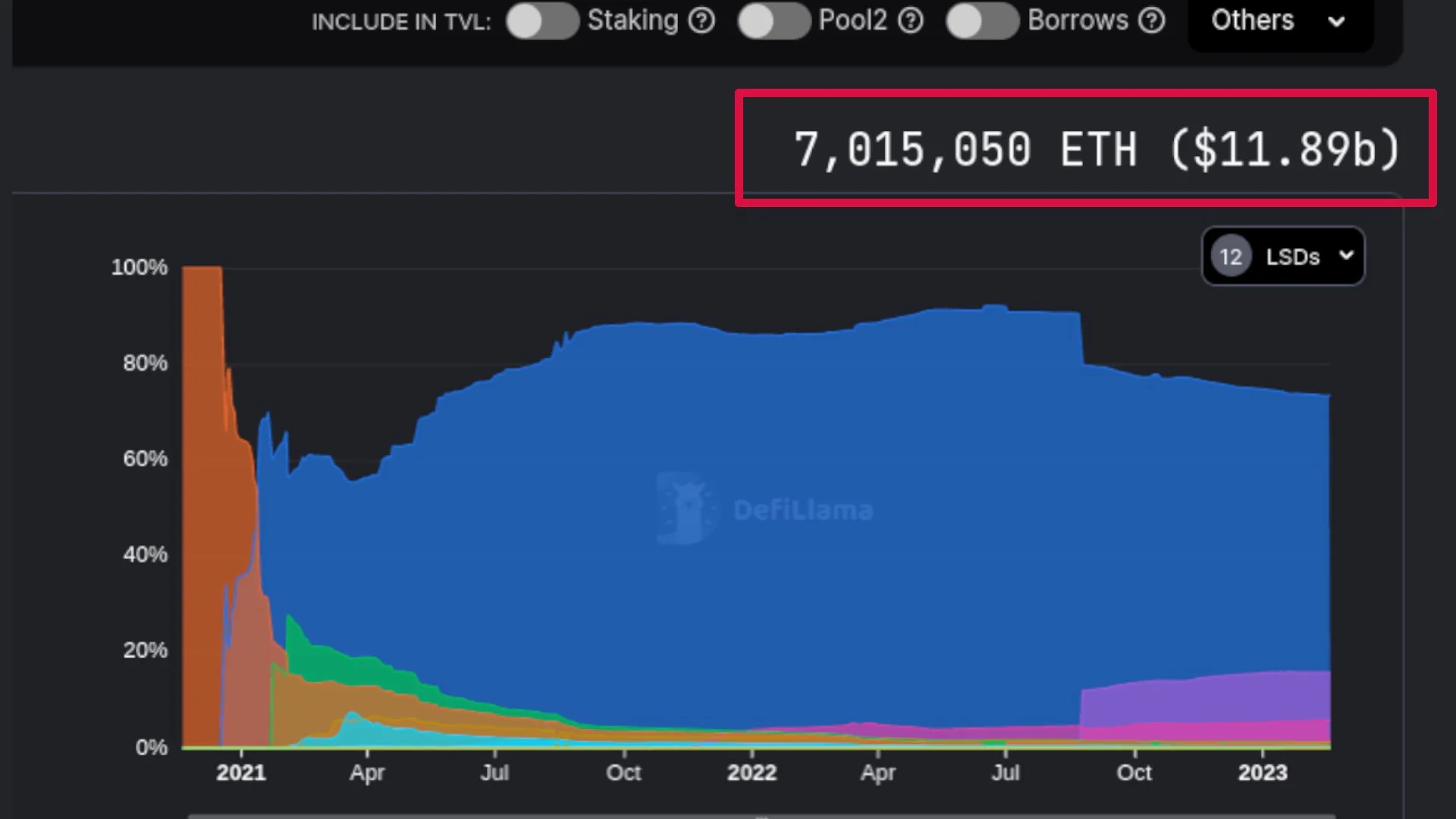

More than 7 million ETH is currently staked on liquid staking protocols, which is roughly 42% of the entire staked amount, valued at $11.8 billion, according to DeFiLlama‘s Feb. 18 report.

Nevertheless, the recent regulatory action by the U.S. Securities and Exchange Commission might mean that Americans may have to look abroad for crypto staking options.

Ethereum price

Despite the fact that Ethereum prices have remained relatively stable in the last 24 hours, trading at $1,687 at the time of writing, the asset has fallen 65.4% from its all-time high of $4,878 in November 2021 after encountering resistance at just over $1,700 over the weekend.

The 1-day technical analysis summary signals for “buy” with a score of 15. Moving averages point to a “strong buy” with 13 signals, while oscillators have 3 signals for “buy”.