Jack Dorsey’s Block Inc. Meets Revenue Goals in Q4 Despite Missing Expectations

Jack Dorsey's Block Inc. announced its Q4 2022 earnings, which missed expectations but still achieved its revenue goals.

Block revealed that its gross earnings are up 40% YoY to $1.66 billion and had $7.5 billion in liquidity in Q4 2022, and the adjusted EBITDA (еarnings before interest, taxes, depreciation, and amortization) significantly contributed to this.

Its liquidity compromises $6.9 billion in cash, cash equivalents, restricted cash, investments in marketable debt securities, and $600 million that could be withdrawn from the revolving credit line.

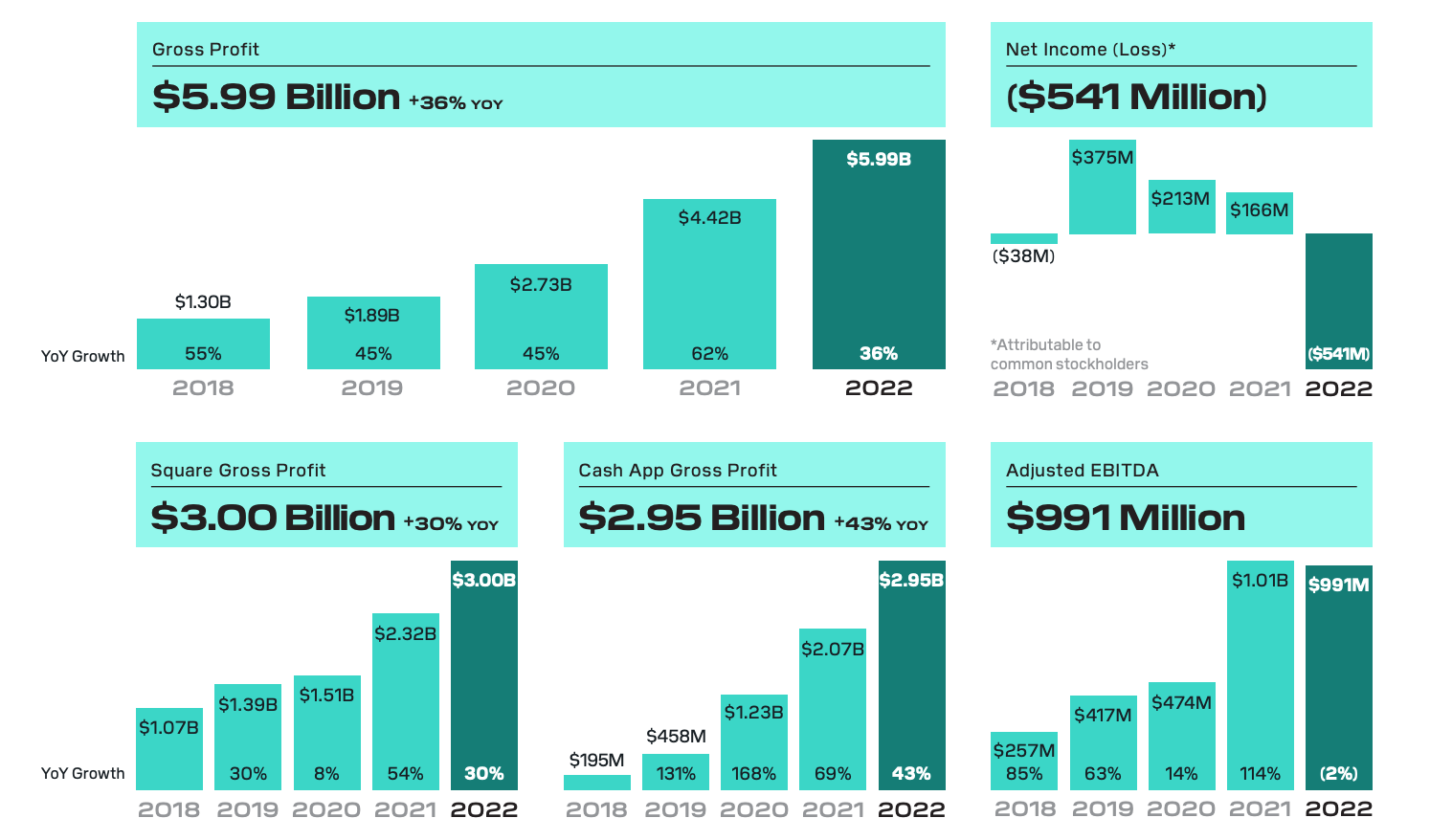

The company’s gross profit for the year was $5.99 billion, up 36% from the previous year.

Following the earnings release, Block’s stock price increased by approximately 8.8% in extended trading.

Cash App, Block’s subsidiary, generated $848 million in gross profit, up 64% YoY.

READ MORE: Crypto Community Raises Millions for Earthquake Relief in Turkey and Syria

According to Dan Dolev, a Mizuho senior financial technology analyst, Block’s superior EBITDA performance was expected, but Cash App and point-of-sale seller KPIs were somewhat disappointing.

He believes that Bitcoin has been a significant problem for Block and that the excessive focus on Bitcoin has undermined its story. He remarked that the story is changing with less emphasis on Bitcoin.