Analyst Shares Warning About Bitcoin

Justin Bennett warned Bitcoin traders, advising them that bears may have the upper hand as long as BTC trades below a crucial resistance.

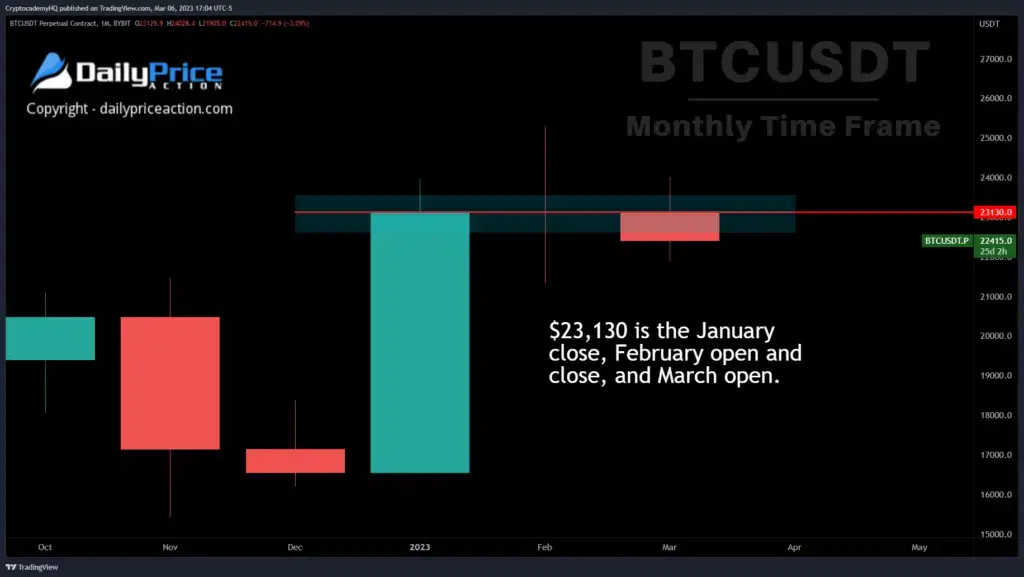

In a new blog post, Bennett explains that Bitcoin’s future direction largely depends on whether or not it can reclaim the key resistance level at $23,130.

Bennett emphasizes that this price level has been a pivotal area for the asset this year, as it encompasses the January close, the February open and close, and the March open. The confluence of these key events makes $23,130 an immensely significant level for Bitcoin, and traders must exercise caution.

With Bitcoin currently trading below this critical price level, Bennett believes that BTC bulls can rely on several support areas to prop up the market. If Bitcoin bulls mount a comeback and take out $23,130, Bennett says there’s nothing stopping the king crypto from going all the way up to $25,200. However, Bennett cautions that shorting BTC while it is above the $22,000 January trend line is ill-advised.

READ MORE: Bitcoin: Analyst Shares Price Target for Next Bull Market

According to the analyst, a daily close below $22,000 would open up the possibility of a dip to $21,500 support and the liquidity pool at $20,800. However, if BTC breaks through the liquidity pool at $20,800, there isn’t much to stop a retest of the $20,000 confluence of support.

Bennett’s analysis highlights the crucial role of resistance and support levels in the Bitcoin market. His warnings demonstrate the importance of paying attention to critical levels to make informed decisions about buying or selling digital assets. As an experienced analyst, Bennett’s insights are highly respected in the crypto community. They may have a significant impact on the market’s future direction.

In addition to technical analysis, crypto traders monitor macroeconomic trends that may affect the market. For instance, if the US dollar and interest rates begin to decline, Bitcoin may gain momentum and push through $25,000, as suggested by Chris Burniske, a partner at venture capital firm Placeholder. This shows that multiple factors can influence the direction of the crypto market, and traders must stay vigilant and well-informed to make adequate decisions.