Binance Coin (BNB) Closing in on $300 – What to Watch Out For?

Bitcoin (BTC) experienced a significant decline and broke through the crucial support level of $26.6k during the release of FOMC minutes on May 24th.

Following the BTC movement, Binance Coin (BNB) also faced bearish pressure and dropped close to $300 at the time of writing.

The current discussions on U.S. debt and the upcoming BTC options expiry on May 26th have the potential to introduce more volatility over the weekend. Consequently, there is a possibility of substantial fluctuations in either direction.

The weakening of BTC reinforces a pessimistic short-term perspective. The 4-hour chart shows a retreat of the RSI to lower ranges, indicating increased selling pressure. Likewise, the On Balance Volume has decreased, reflecting a decline in demand.

Consequently, short-sellers may continue to profit beyond the lower range of $304. If this range is breached, the next support level to watch is the psychological threshold of $300. A drop below $300 could expose BNB to more intense selling.

Alternatively, if BTC avoids dropping to $25k and reclaims the $26.6k level, the bulls may defend the lower range of $304. In such a scenario, BNB could rally towards the mid-range of $309.7 or even reach the upper range of $315.5.

READ MORE: Michael Saylor Envisions Major Banks Embracing Bitcoin Custody

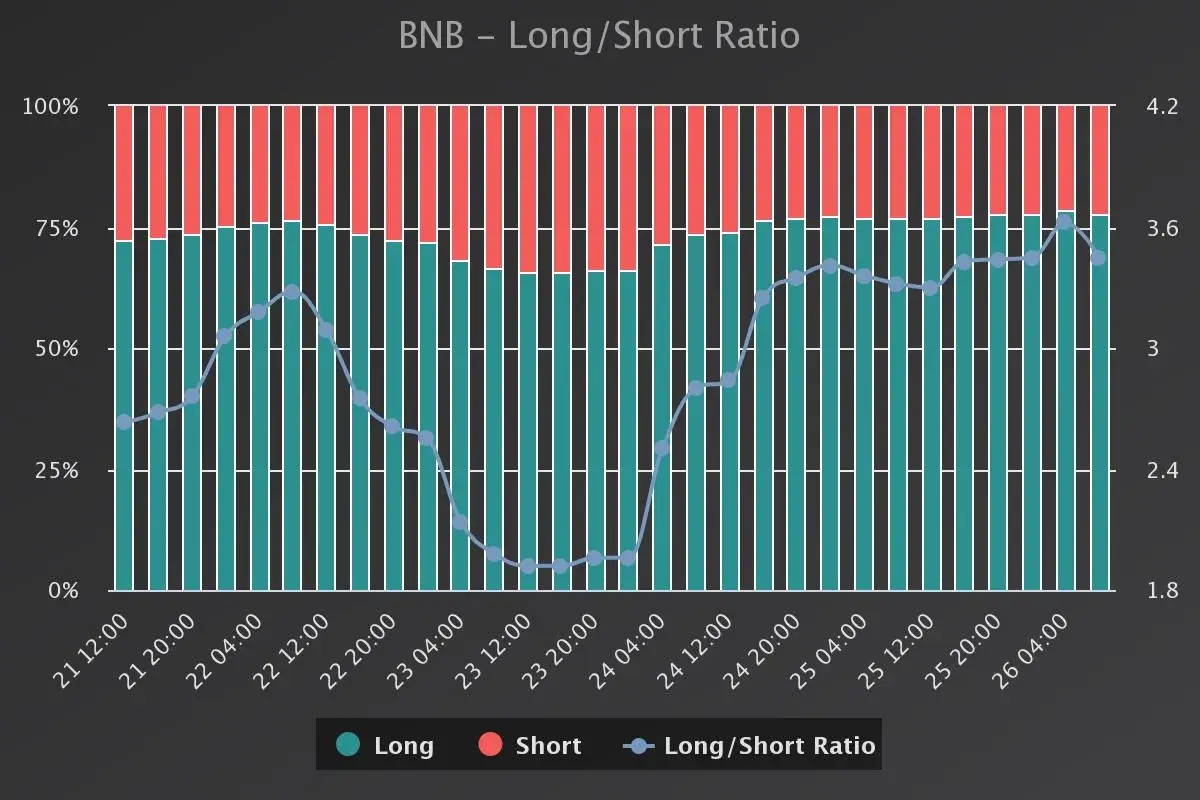

Coinglass’s data on liquidations in the past four hours further reinforces the bearish short-term outlook. Approximately $139k worth of long positions were liquidated, compared to only $115 in shorts. This suggests that sellers can potentially extend their gains beyond $304.

Meanwhile, the open interest rates for BNB futures have remained below $320 million since mid-May, following BNB’s drop below the $320 price level. This low open interest could hinder a strong recovery unless BTC reclaims the previous support level of $26,600.