Binance Surpasses CME in Bitcoin Futures Preference

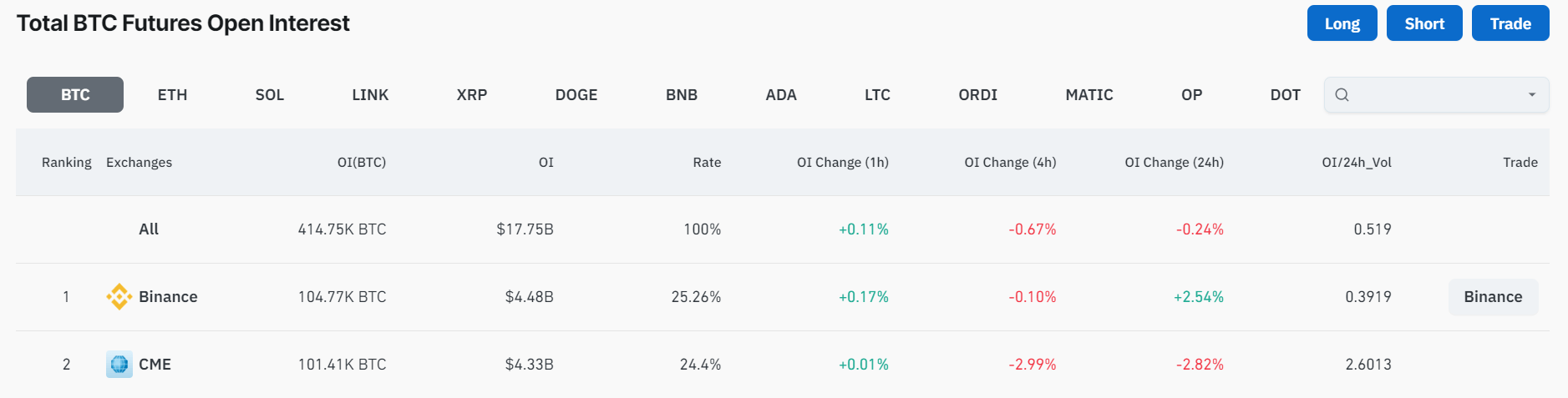

Binance has once again surged ahead of CME to become the top exchange for Bitcoin futures open interest, marking a significant shift in the cryptocurrency market landscape.

This change reflects the total value locked in open futures contracts, with Binance now holding approximately 105,000 BTC compared to CME’s roughly 101,000 BTC.

Data analysis indicates a notable trend: investors are moving away from higher-cost futures contracts like BITO towards more budget-friendly spot Bitcoin ETF products following the ETF’s approval. This strategic realignment has caused a notable 30% decrease in futures open interest on CME.

READ MORE: Korean Financial Regulator Eyes Bitcoin Talks With the US SEC for ETF Insights

Additionally, Binance’s market dominance is now nearing 30%, while the overall open interest is on a downward trajectory, hovering just below 400,000 Bitcoin. This represents one of the lowest levels recorded over the past year.

These developments suggest a broader shift among investors towards seeking exposure to more affordable products, particularly spot products, as they navigate the evolving cryptocurrency landscape.