Bitcoin Approaches $60K as Exchange Reserves Hit 2018 Lows

Bitcoin (BTC) is showing strong upward momentum as it nears the $60,000 mark, with prospects for further gains.

The cryptocurrency has risen over 6% in the past week and continues to climb, trading at approximately $59,256.11 with a market cap of $1.17 trillion.

Notably, historical patterns suggest BTC may be entering a significant growth phase. Analyst Titan of Crypto observed that Bitcoin has previously hit new highs following its third parabolic surge, which occurred in 2013, 2017, and 2021. BTC’s current position could signal the start of a similar advance.

#Bitcoin 3rd Parabolic Advance in Progress 📈🚀

The blueprint I shared last November is unfolding as planned.

Spread the word. pic.twitter.com/RJ0p0WN6iQ

— Titan of Crypto (@Washigorira) August 11, 2024

Recent data from CryptoQuant reveals that Bitcoin’s exchange reserves are at their lowest since 2018, indicating increased buying interest—a bullish sign.

READ MORE: El Salvador Secures $1.6 Billion Investment to Develop Bitcoin City

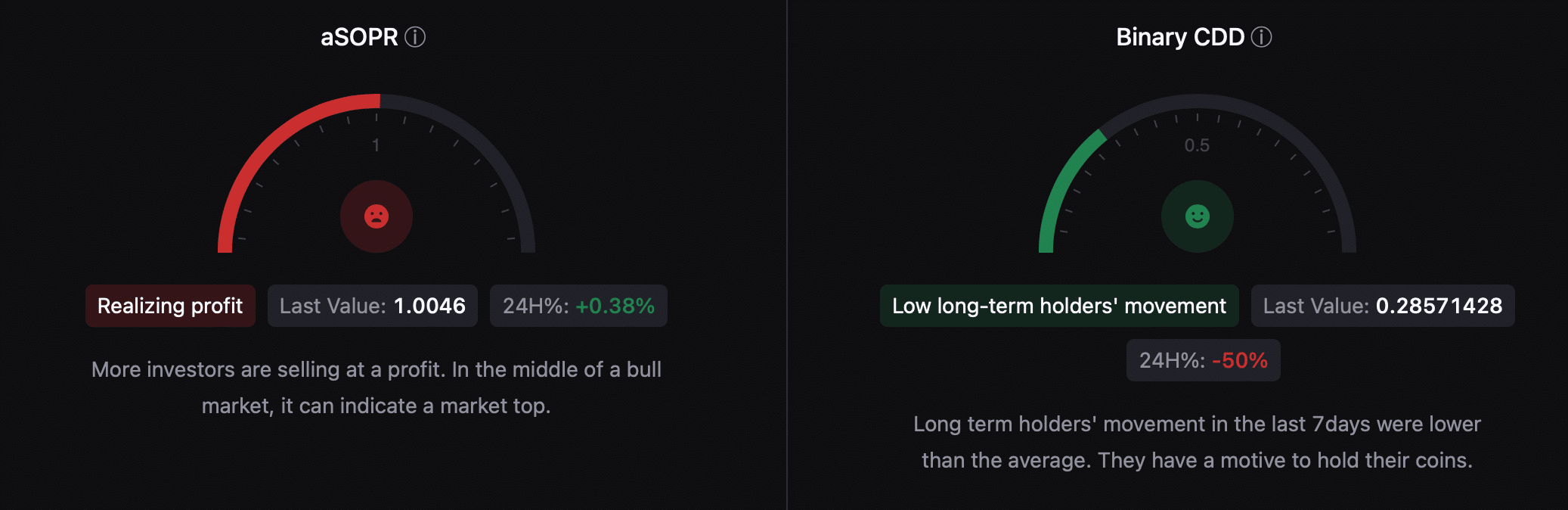

Although long-term holders are retaining their assets, as shown by a positive Binary CDD, there are concerns about profit-taking among investors, which could signal a market peak.

Technical indicators show mixed signals: the MACD suggests bullish momentum, while the Chaikin Money Flow is positive, signaling potential further gains. However, the Money Flow Index indicates a period of slower growth ahead.