Bitcoin Forecast: Analyst Points to Bullish Phase Highlighting the Cryptocurrency’s Resilience

Michael van de Poppe, a prominent figure in market analysis, expresses confidence in the current crypto landscape, particularly highlighting the resilience of Bitcoin (BTC).

The leading cryptocurrency has witnessed a staggering YTD surge, escalating from approximately $15,000 a year ago to its current valuation of over $37,000. This substantial 124% increase signifies a pivotal moment, suggesting the initiation of a new bull cycle.

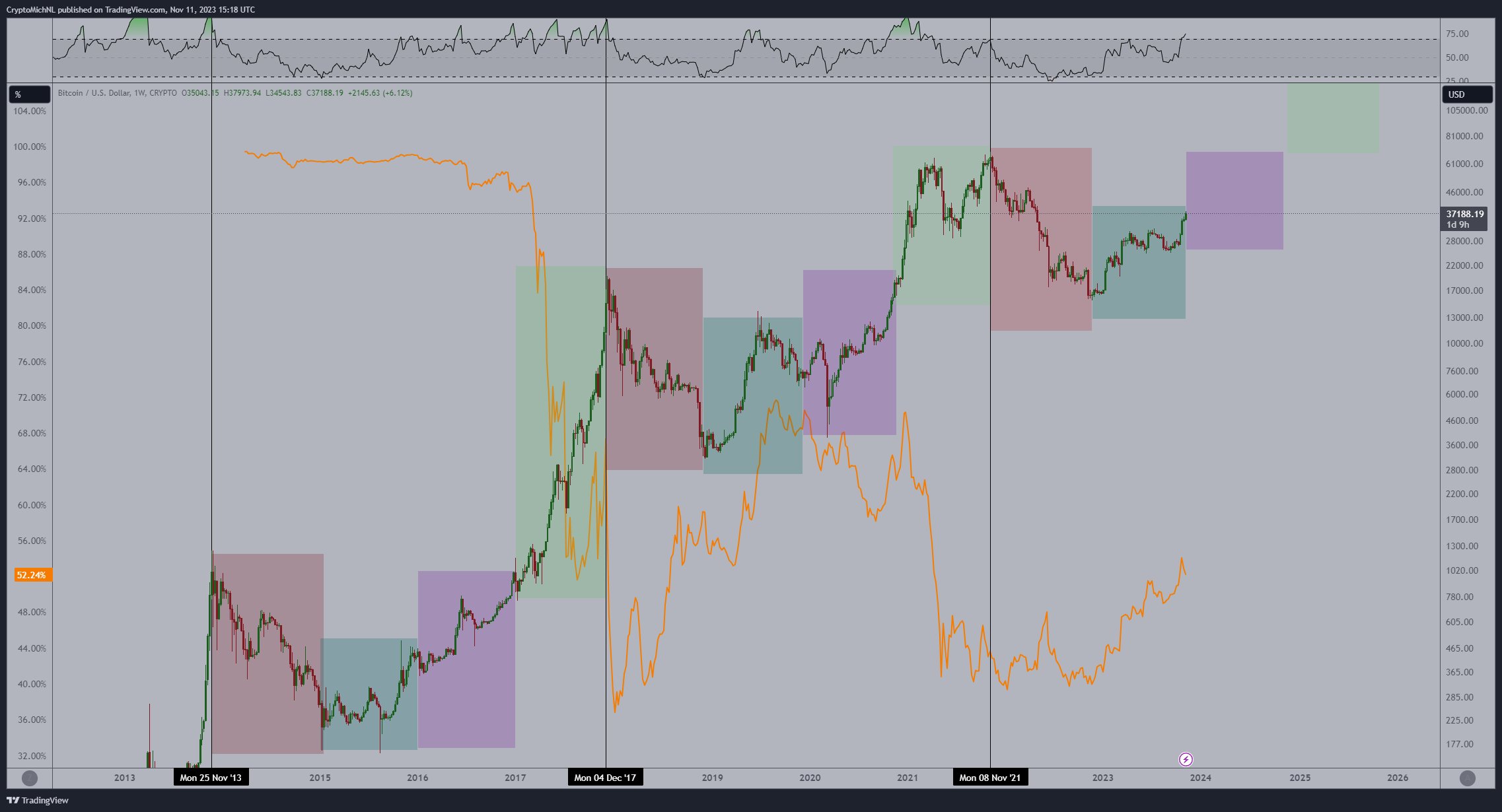

Analyzing Bitcoin’s trajectory using van de Poppe’s provided chart, a discernible cyclic pattern emerges. The pattern involves a year characterized by intense bearish pressure, followed by a year marked by significant accumulation, succeeded by a bullish phase, and concluding with a mania phase often associated with parabolic price movements.

Bitcoin appears to be on the cusp of entering the initial year of the bull phase, as indicated by the highlighted purple box in the chart. Analysts in the space echo this sentiment, citing a consistent trend of accumulation over the past year, with notable entities like MicroStrategy reaffirming their commitment to Bitcoin.

Van de Poppe anticipates further positive momentum, speculating on the SEC’s potential approval for a Bitcoin spot ETF, coupled with the impending halving event.

These factors, if realized, could catalyze the market into a mania phase, potentially propelling Bitcoin to retest its ATH in the ensuing months. This outlook is shared by various industry experts, who foresee substantial price targets for Bitcoin in anticipation of the Bitcoin ETF and the four-year halving event.

READ MORE: Citibank Faces Lawsuit Over $120K Disappearance From Client’s Account

Van de Poppe’s analysis suggests varying behaviors for most altcoin throughout the Bitcoin growth cycle. During the accumulation phase, altcoins typically endure a bear market, swiftly transitioning to a more positive trajectory during subsequent bull and mania phases.

Current observations in altcoins, including Solana (SOL), Chainlink (LINK), and the notable resurgence of the FTX Token (FTT), seem to align with van de Poppe’s analysis.