Bitcoin: Market Theory Gives Hope to the Bulls

The recent decrease in the price of Bitcoin has caused many people in the cryptocurrency market to be concerned about the possibility of a major correction.

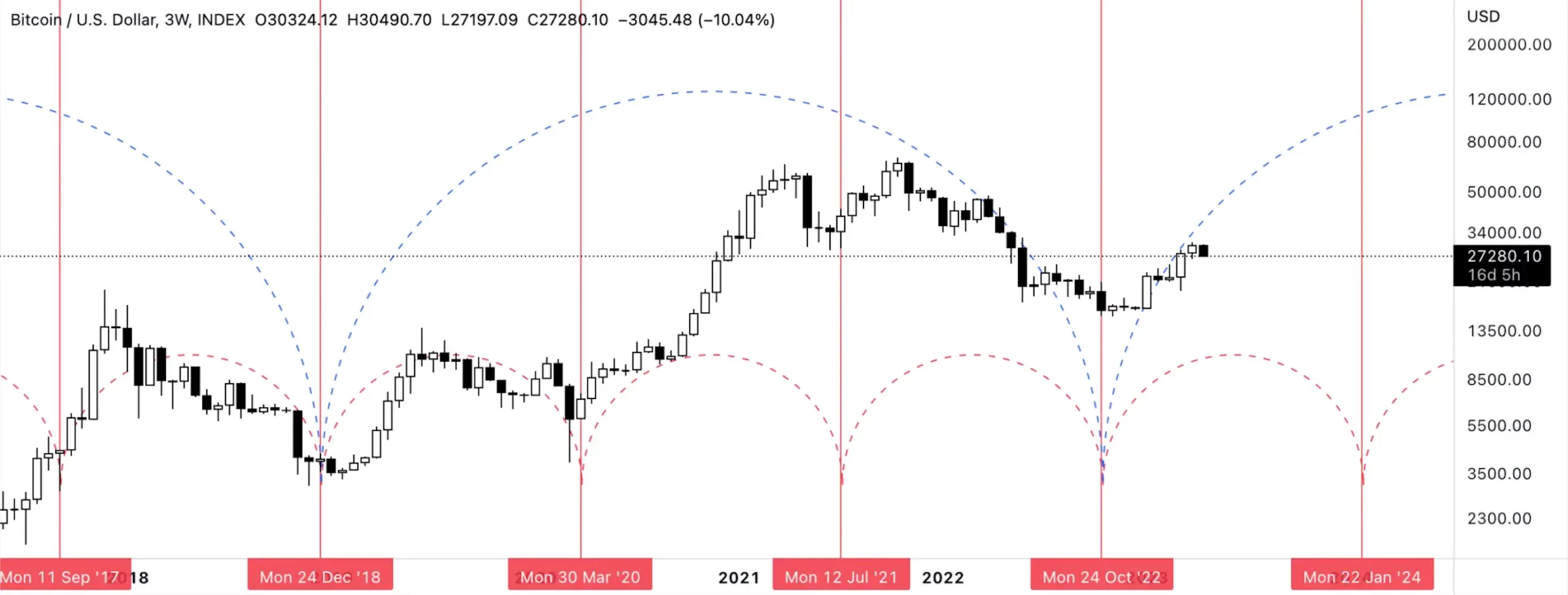

However, the Hurst Cycle Theory, created by American engineer JM Hurst in the 1970s, suggests that Bitcoin bulls have time on their side and that a correction may not be due for a while longer.

The Hurst Cycle Theory comprises eight fundamental principles: Commonality, Cyclicality, Summation, Harmonicity, Synchronicity, Proportionality, Nominality, and Variation. Essentially it seeks to identify a repetitive time pattern measured from trough to trough.

Based on this theory, past corrections of 50% or more have followed a cyclical pattern. The time cycles indicate that the next major trough is not expected until at least January 2024.

These major troughs date back to the significant correction in 2017, followed by the 2018 bear market bottom, the COVID-induced market collapse in 2020, and another trough in the summer of 2021, with yet another in November 2022. However, it remains unclear if the latest trough is a long-term bottom.

READ MORE: Bitcoin: Price Continues to Crash Dragging the Whole Crypto Market Along

The next major cyclical trough with significant Summation is not expected until mid-2026. Therefore, not only do the shorter time cycles suggest that there will be no significant bearish movements in the short term, but the larger time cycles also indicate the same.

The Principle of Harmonicity proposes that larger time cycles can be broken down into halves and thirds. When measured as the 1/3 harmonic, the smaller time cycle takes us back to several significant bear market bottoms.

While the Hurst Cycle Theory does require some subjectivity, it suggests that Bitcoin may not be due for a major correction for several more months. However, there’s no telling if the above is perfectly accurate or if the current cyclical structure begins to change or feature more variation. If the drawings are accurate, it won’t be time for a bigger correction for several more months.