Capitalizing on Bitcoin Profits: Market Sentiment and Correction Signals

Bitcoin's recent surge suggests a potential turning point in the market dynamics, prompting traders and investors to closely monitor for shifts in sentiment.

Following a brief rebound subsequent to comments from the Fed, Bitcoin has once again entered a phase of substantial consolidation. As it stands, the price of Bitcoin hovers around $66,600, accompanied by a market capitalization of $1.308 trillion.

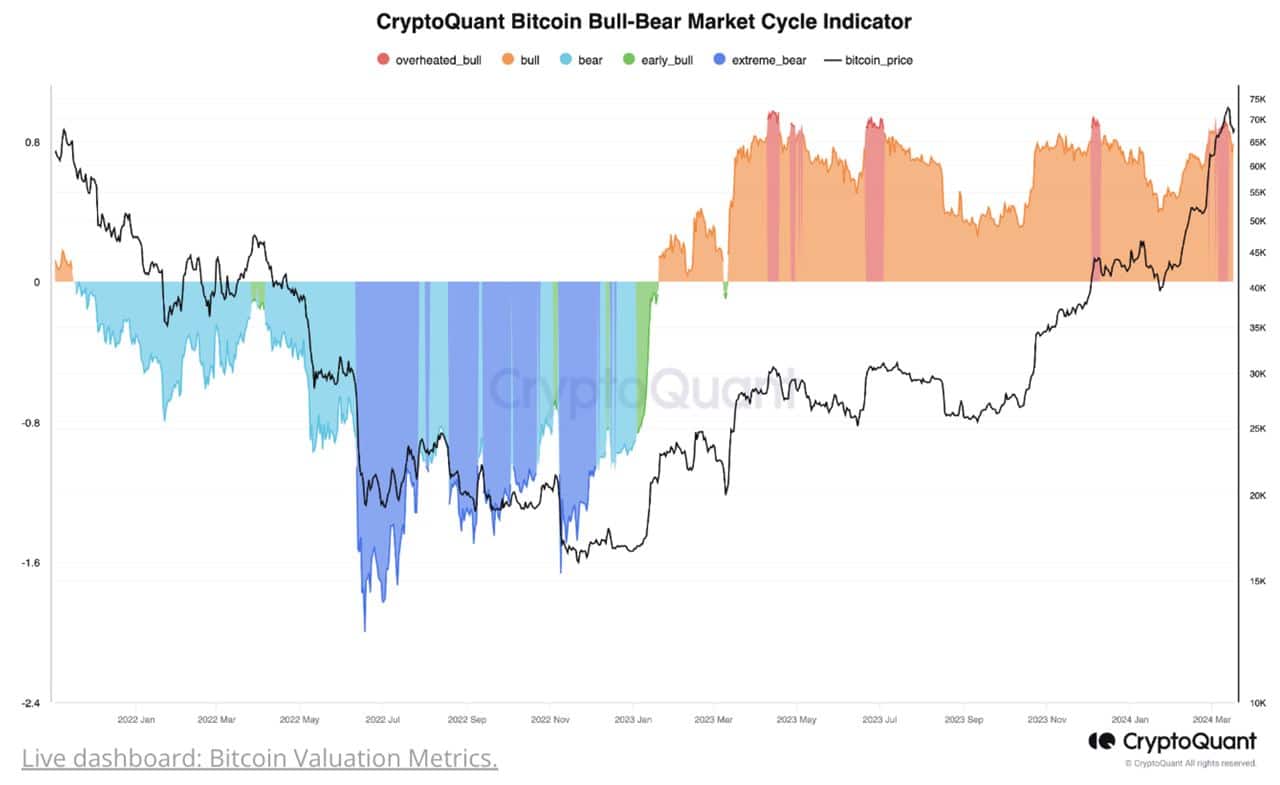

Indicators such as the Bull-Bear Market Cycle Indicator from CryptoQuant are pointing towards an overheated bull phase, raising concerns about the sustainability of the ongoing rally.

Additionally, the persistence of notably high unrealized profit margins among traders indicates a potential overheating of the market. Echoing these sentiments, a report from JPMorgan suggests that Bitcoin currently resides in an ‘overbought’ territory, with potential corrective movements towards the $51,000 mark looming on the horizon.

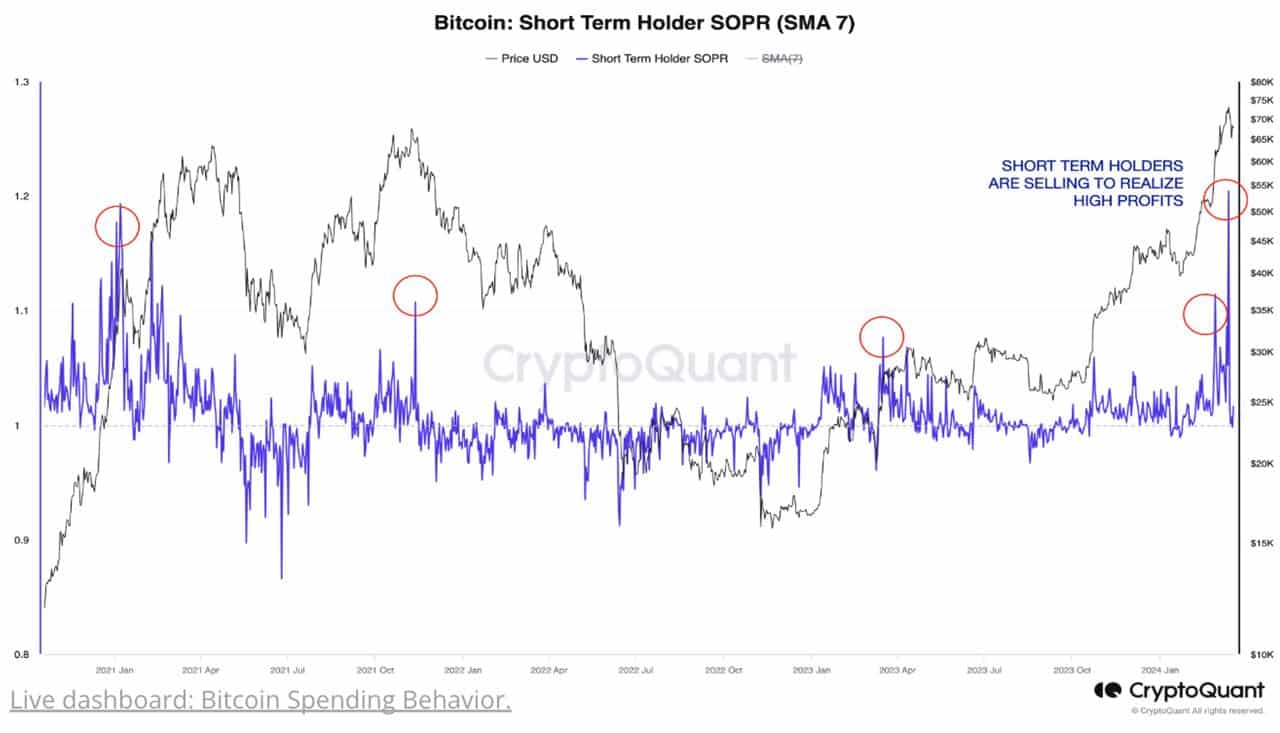

In light of these observations, recent market data reveals a significant uptick in selling activity among traders, driven by the desire to lock in profits amidst the prevailing bullish momentum. This surge in selling, not witnessed since May 2019, underscores a growing trend among traders to secure gains.

READ MORE: Federal Reserve Chair Dismisses Secret CBDC Plans

Furthermore, notable Bitcoin holders, including large investors and miners, have intensified their selling activities, offloading their holdings as prices soar to unprecedented levels. Such behavior among significant holders emphasizes a potential shift in sentiment, as market participants capitalize on recent price surges.

These developments highlight the evolving nature of the Bitcoin market, prompting investors to closely analyze various indicators and metrics to gauge the sustainability of the current rally and anticipate potential market corrections.