Institutional Investors Show Renewed Interest in Bitcoin

Bitcoin maintains its position above the $70,000 mark despite a relatively quiet holiday period in the cryptocurrency market.

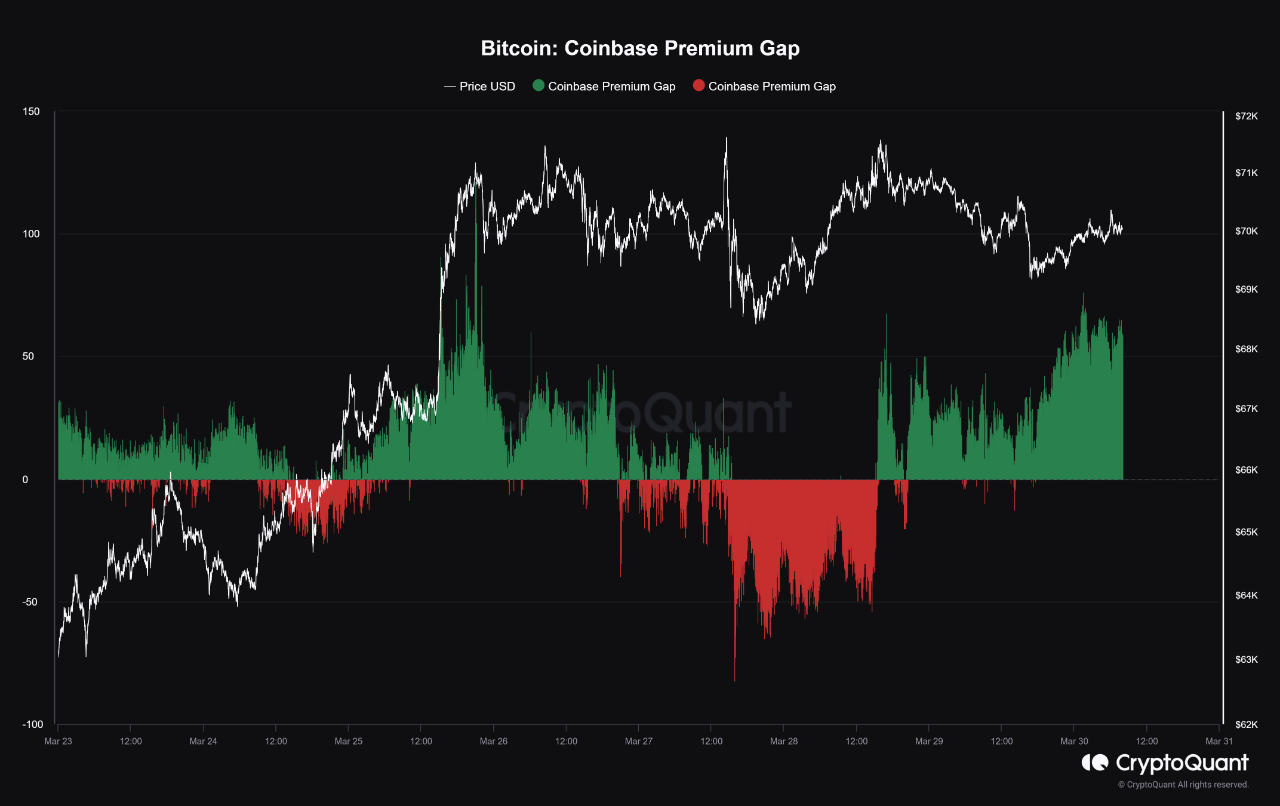

However, there are signs of renewed interest from institutional investors, as indicated by the Coinbase premium gap.

The resurgence in institutional buying became apparent towards the end of March 29, coinciding with the release of the US PCE inflation data. This was reflected in the Coinbase premium gap, which exceeded 50 since March 30, suggesting a possible return of US institutions to Bitcoin investments.

The Coinbase premium gap, a comparison between Coinbase Pro’s USD pair price and Binance’s USDT pair price, is closely watched as an indicator of institutional activity in the market.

Analysts have noted a divergence between hedge funds and asset managers, with the former increasingly engaging in short-selling while the latter continue to purchase Bitcoin futures. This dynamic hints at a potential short squeeze in the midst of the current bullish sentiment, which could drive Bitcoin’s price higher.

READ MORE: Institutional Investments in Bitcoin Expected to Surpass $1 Trillion

Michael van de Poppe, a well-known analyst, observes that despite Bitcoin’s recent sideways movement around $70,000, the cryptocurrency remains on track with its long-term cycle. He predicts that in five years’ time, a price of $70,000 per Bitcoin may be considered inexpensive.

#Bitcoin consolidates, through which the real movements are likely to start from Tuesday.

If $67K holds, I'll suggest we'll have a final ATH test pre-halving. pic.twitter.com/9bX9p6ltvY

— Michaël van de Poppe (@CryptoMichNL) March 31, 2024

However, trading activity in futures and options markets has been subdued due to the holiday period, with traders adopting a cautious approach while awaiting further developments in Bitcoin’s price. CME BTC futures open interest has seen a slight decline to $11.64 billion, while total BTC options open interest has dropped from $32.31 billion to $21.52 billion.