Rising Interest Rates and Uninsured Deposits Pose Threat to U.S. Banking System Stability, Analysis Shows

Experts are warning of potential instability in the US banking system due to rising interest rates and many uninsured deposits at some US banks.

In fact, a recent analysis by economists suggested that nearly 190 banks operating in the United States are potentially at risk of a run.

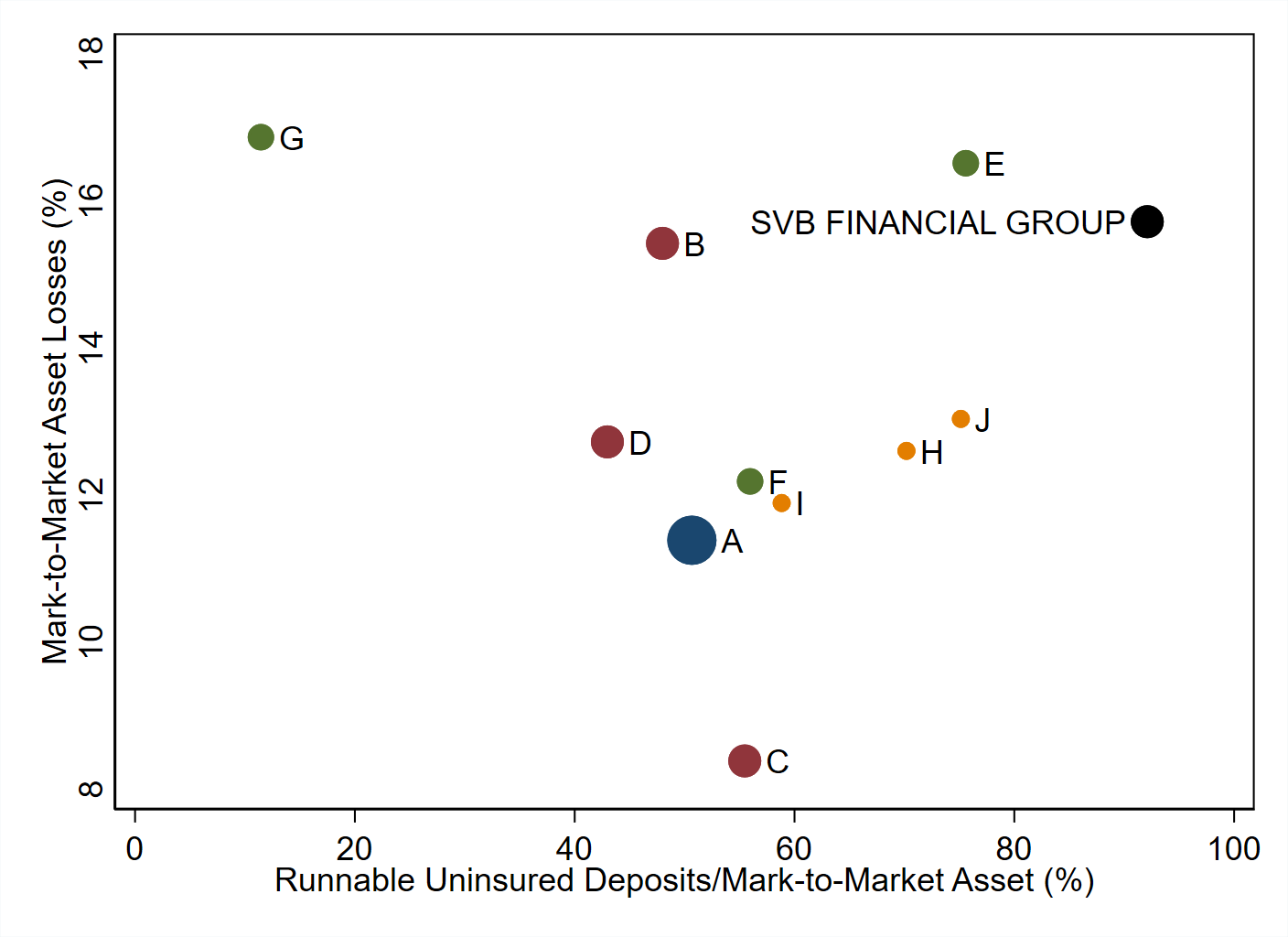

The collapse of Silicon Valley Bank (SVB) is one example of how these factors can have disastrous consequences. SVB’s extensive loan portfolio, combined with losses, uninsured leverage, and other factors, contributed to its downfall. Comparing SVB’s situation with other banks revealed that many others may also be at risk.

Even if only half of the uninsured depositors decide to withdraw, the report warns that almost 190 banks are at risk of impairment to insured depositors, potentially putting $300 billion of insured deposits at risk.

The study also explains that central banks’ monetary policies can hurt long-term assets such as government bonds and mortgages, creating losses for banks. If a bank’s mark-to-market value of assets is insufficient to repay all insured deposits once uninsured depositors are paid, the bank is considered insolvent.

This data in the above graph represents the assets based on bank call reports as of Q1 2022. Banks in the top right corner, alongside SVB (with assets of $218 billion), have the most severe asset losses and the most significant percentage of uninsured deposits to mark-to-market assets.

READ MORE: Who is Satoshi Nakamoto, The Mysterious Creator of Bitcoin?

The recent rise in interest rates, which brought down the US banking system’s asset market value by $2 trillion, combined with a high share of uninsured deposits at some US banks, is causing concern about the banking system’s stability.

In response to the collapse of SVB and Signature Bank, the federal government has stepped in to protect depositors, with President Joe Biden assuring taxpayers that there will be no impact on them. However, some critics have argued that this is not the case.