Solana (SOL) Emerges as Strong Ethereum Rival, According to a Coinbase Analysis

With the emergence of so many Ethereum scaling solutions, people wonder which blockchain protocol could become the most potent rival for the number one altcoin project.

According to a recent analysis by Coinbase, Solana (SOL) has the potential to be one of the leading layer-1 blockchain projects in the US.

The report suggests that Solana could emerge as one of Ethereum’s top competitors in the race for capital and users among the numerous layer-1 blockchains vying for market share.

Solana emerging as one of the best blockchains out there

The competition between layer-1 blockchains to gain more capital and users is becoming more intense, and Solana seems to have gained a considerable amount of mindshare since its inception. Despite its recent setback due to the FTX collapse, Solana’s ecosystem is still focused on strengthening its technological advantages.

The Solana protocol offers a differentiated approach within the layer-1 landscape, optimized for high throughput, minimal costs, and native scalability.

Developer activity

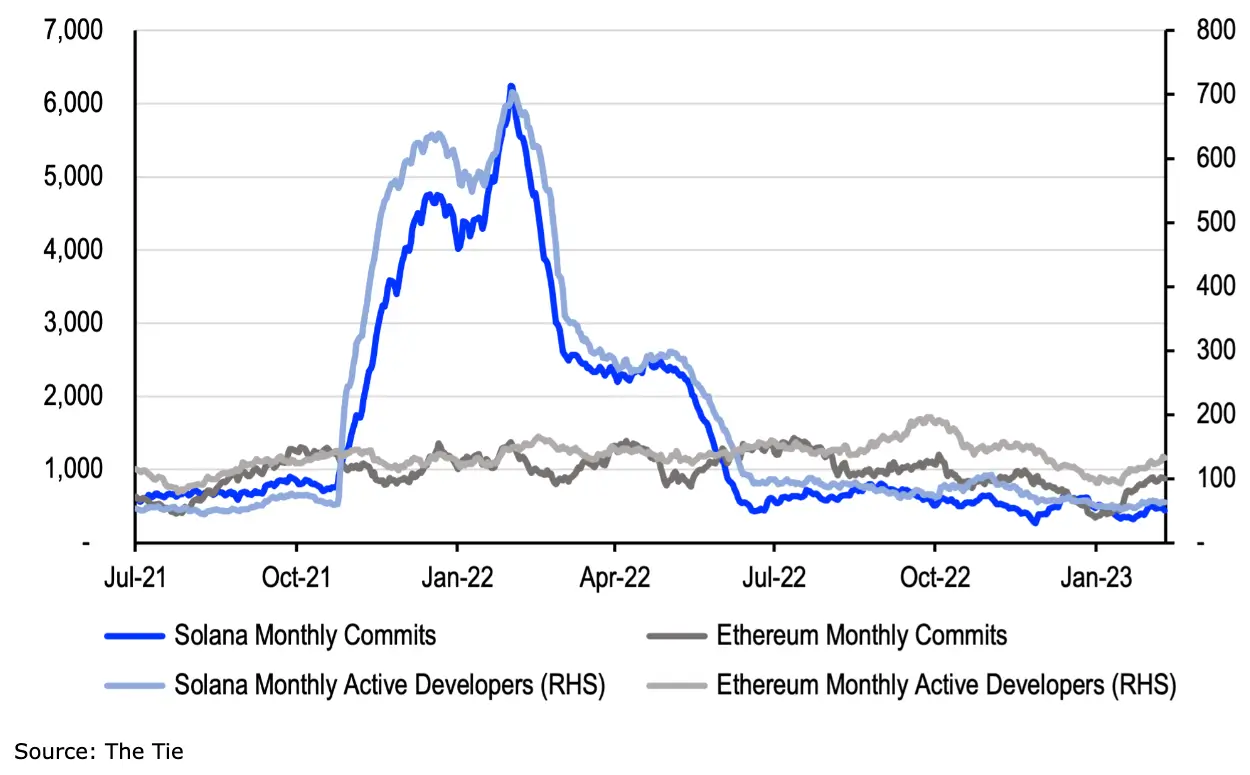

The following chart compares developer activity on Solana and Ethereum – based on Github data, Solana experienced impressive growth in late 2021/early 2022, surpassing Ethereum’s developer activity.

However, Solana’s developer activity declined below Ethereum’s in May 2022. Currently, there are 63 active developers on Solana, versus 133 active developers on Ethereum (defined as developers who commit code 5+ days of a month). Solana disputes these numbers, claiming that the total developer community working on Solana is not entirely captured by Github repositories.

They estimate 120 full-time developers, which still shows relative strength compared to Ethereum, even with the large difference in market capitalization. Electric Capital’s recent developer activity report takes a broader approach, suggesting 383 full-time developers for Solana versus 1,873 for Ethereum as of mid-December.

Staking on Solana

Currently, approximately 70.36% of all eligible SOL is staked, resulting in an average annualized staking yield of around 6.92%, according to Staking Rewards.

As the issuance rate decreases per the schedule, validators will depend more on transaction fees for compensation. This implies that network activity will need to grow significantly over time to promote a more active fee market.

Downtime concerns

On February 25, the network experienced performance degradation issues that led to transaction disruptions, prompting validators to restart the network.

A community member expressed concern about the impact of network outages on decentralized financial protocols running on the Solana blockchain.

READ MORE: 60% of Weapons Suppliers to Ukraine Accept Crypto Payments

The concerns were shared on social media, with some questioning Solana’s ranking as a top cryptocurrency.

Solana price

Although the value of SOL has decreased by almost 16% from its weekly high of $26.44, Coinbase believes that Solana is well-positioned to reassert itself as a legitimate competitor in the layer-1 market due to its strong ecosystem in terms of network activity, transactions, users, and development.

At the time of writting Solana is trading at $22.24 with a 2.4% decrease in the past 24 hours.

The 1-day technical analysis from TradingView flashes sell signals. Moving avereges and oscillators point to “sell” at 10 and respectively 2.