Tether Dominates Stablecoin Market as Total Supply Shrinks in 2023

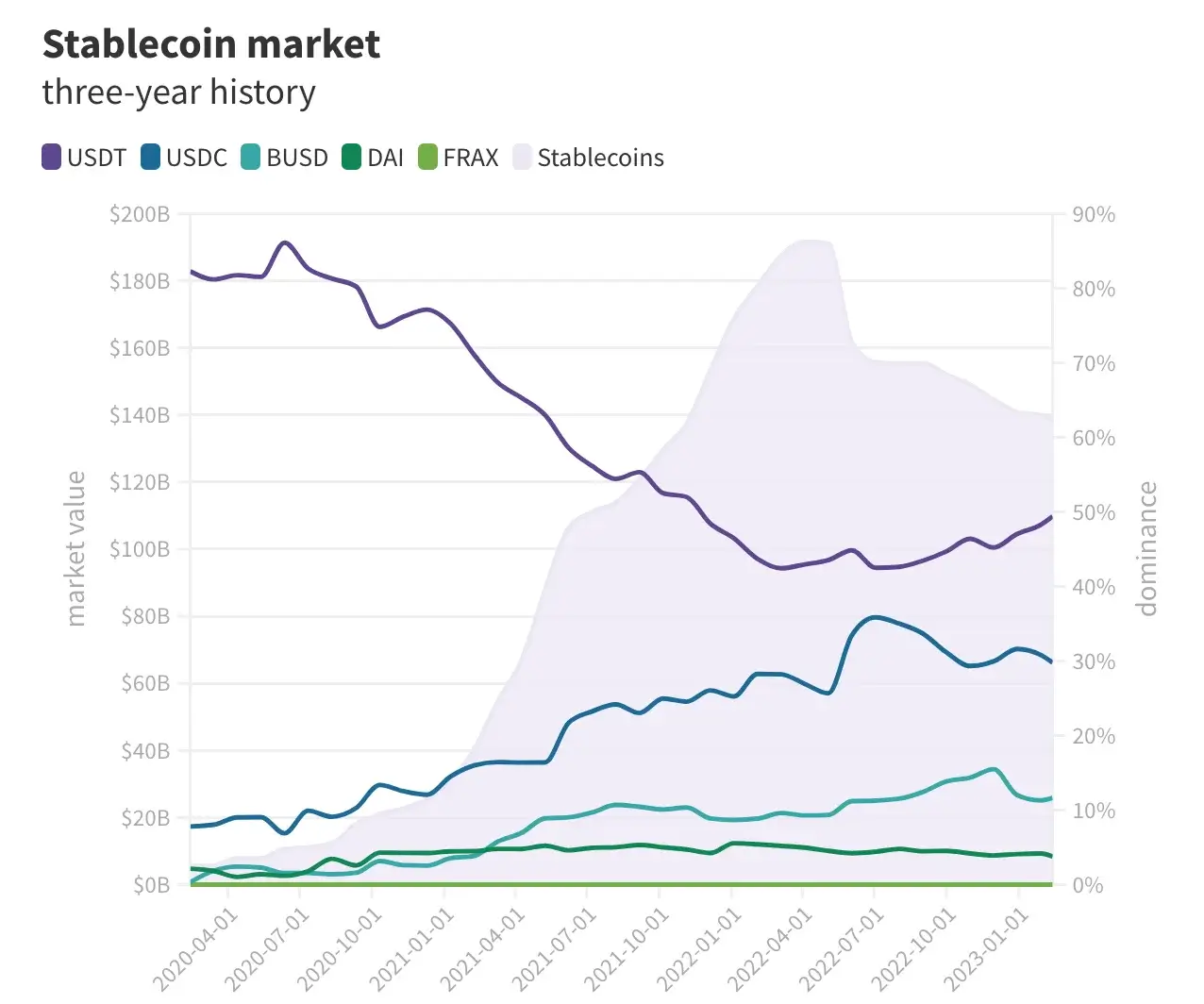

Tether (USDT) is once again the preferred stablecoin of the crypto world, with its market share approaching 50% for the first time in a year.

The leading stablecoin issuer has added $2.4 billion USDT to its current circulating supply of $68.4 billion, representing a 3% growth. In comparison, Circle’s USDC has lost over $3.3 billion in supply, resulting in a 7.5% decrease to $41.2 billion.

Meanwhile, Binance’s BUSD, managed by Paxos, comes in third place with $16.1 billion but has seen a 3.5% decrease in supply since the start of the year.

The stablecoin market capitalization stands at approximately $138.5 billion, with Tether making up 49.39%, USDC at 29.76%, and BUSD at 11.63%.

DAI holds fourth place, the decentralized stablecoin maintained by MakerDAO, with a much smaller supply of $5.19 billion and a loss of 10% in market cap this year.

FRAX, with its algorithmic element, has remained steady in fifth place, while TrustToken’s TrueUSD (TUSD) has seen growth, adding 25% more supply this year.

READ MORE: Bitcoin (BTC): Is the Recent Price Surge a Sign of a New Bull Market Trend?

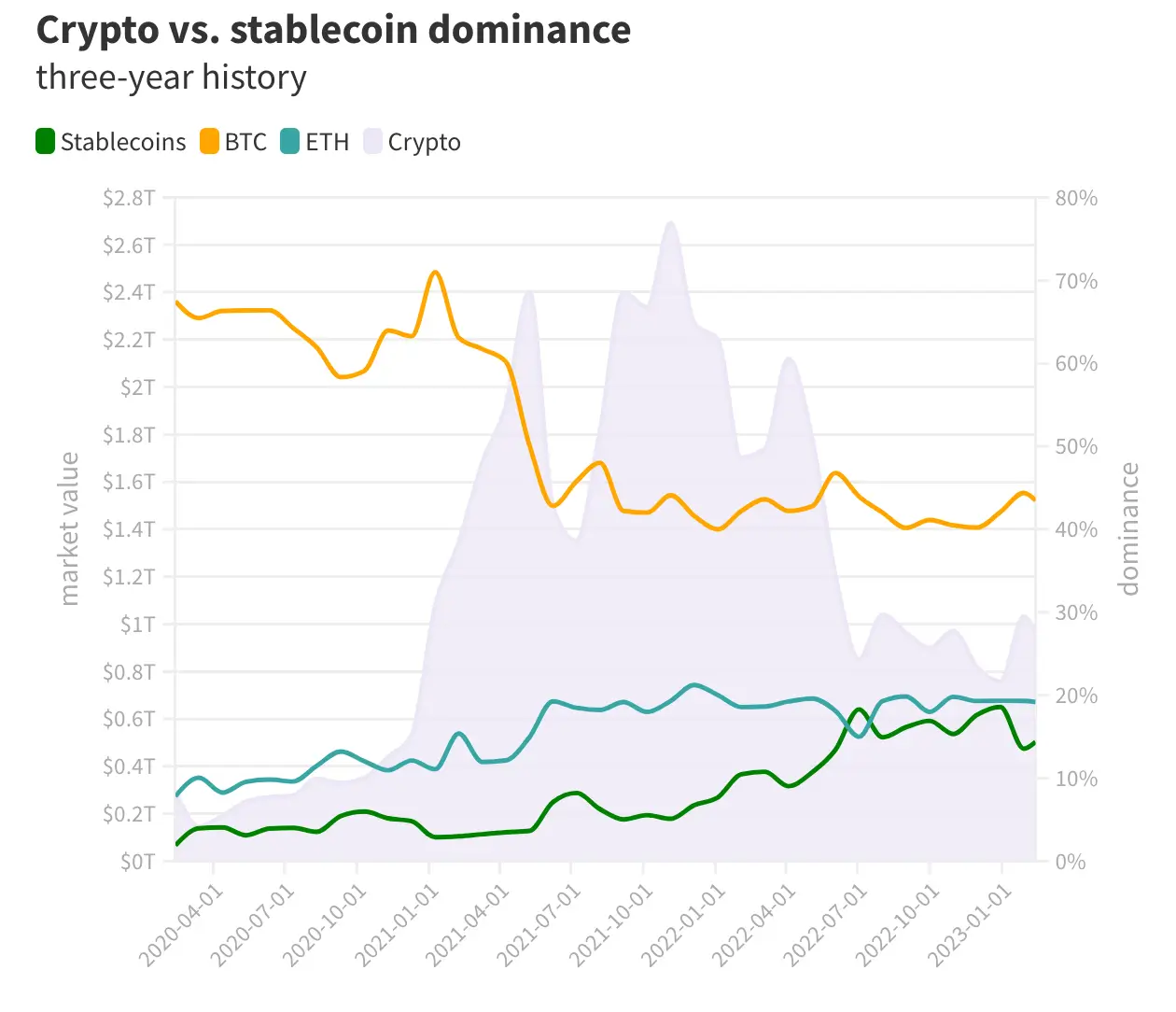

Overall, the stablecoin market has shrunk by 1.5% this year, losing over $2.1 billion in total. The stablecoin dominance in the crypto world reached a record high of just below 20% last November but has since declined to 14.38% as the crypto markets have recovered.