The US Dollar’s Decline: A History of Currency Depreciation

Global conflicts have significantly impacted the extensive usage of the US dollar, resulting in a notable depreciation of its value.

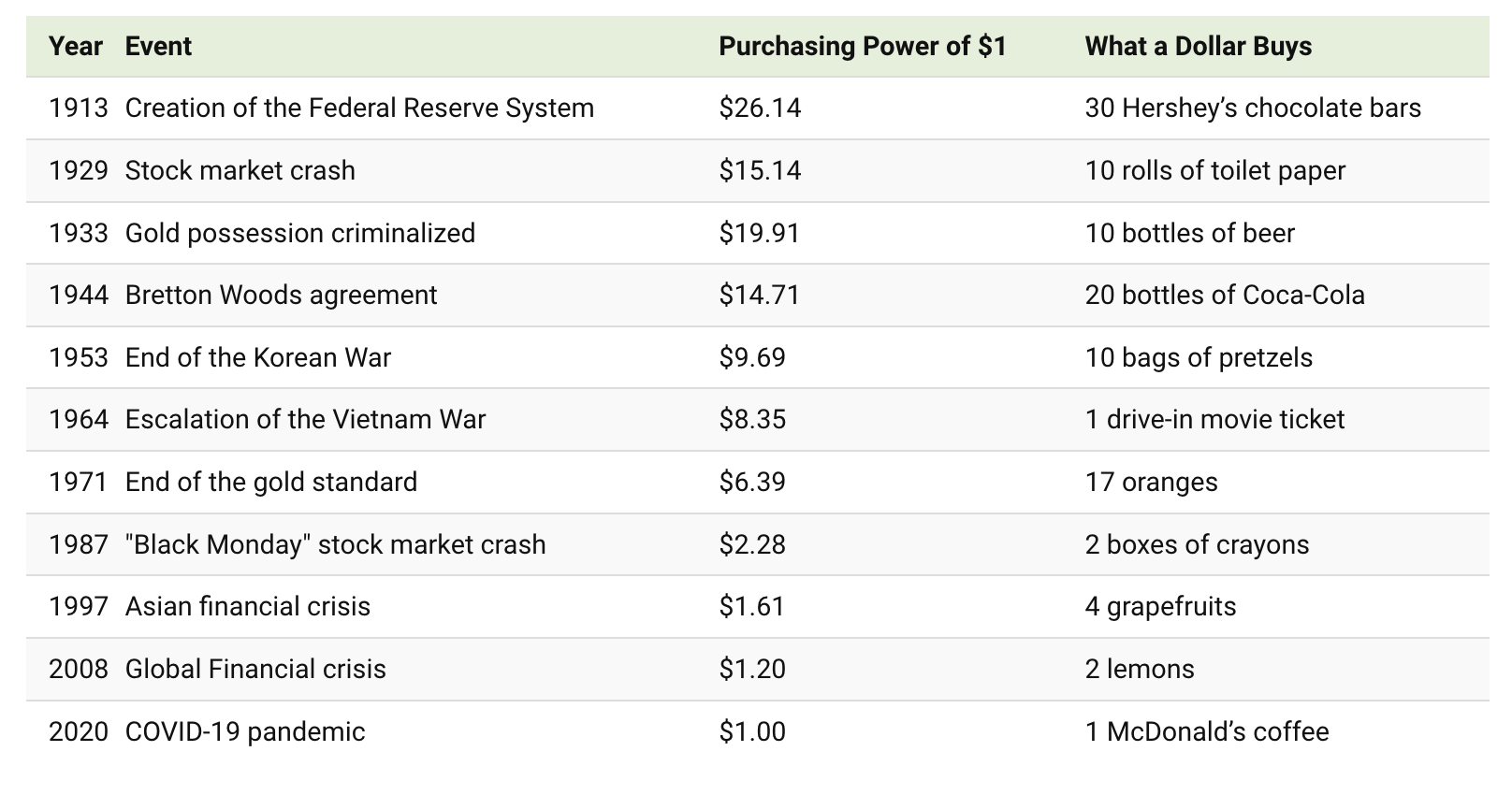

According to Visual Capitalist’s data, the US dollar’s purchasing power has declined by a staggering 98% since 1971, signifying a significant currency weakening over the years.

This is due to the rise in price levels and the increase of US dollars in circulation, which decreased the currency’s value in 1913 after the Federal Reserve Act was enacted.

For instance, in 1933, one US dollar could buy ten bottles of beer, while today, it can only purchase a small cup of coffee from McDonald’s.

As a result, the purchasing power of the Consumer Price Index (CPI) had already decreased by 73% in 1929.

The money supply in the US has risen from $4.6 trillion in 2000 to $19.5 trillion in 2021, with a significant increase of $3.4 trillion in 2020 due to the COVID-19 pandemic.

The US dollar’s decline in value particularly concerns in light of international trade developments.

READ MORE: Bitcoin and Ethereum to Benefit from US Economic Slowdown, According to M. Novogratz

Saudi Arabia’s finance minister, Mohammed Al Jadaam, recently indicated a willingness to trade with alternative currencies, stating there were no issues settling trade arrangements in the US dollar, the euro, or the Saudi Ryal.

This coincides with actions taken by BRICS nations to challenge the US dollar’s dominance in international trade.

The Federal Reserve has cautioned that the US banking crisis could result in a recession later this year, as per the minutes of the Federal Open Market Committee’s March meeting. During the meeting, staff members presented on the possible outcomes of the financial sector’s disturbances that began in early March, including the failure of Silicon Valley Bank.

While the topics discussed in the recent FED meeting suggest that the US banking crisis may have a detrimental impact on the economy and lead to a recession in the near future, the Fed has implemented measures to manage inflation and guarantee uninterrupted banking operations.