Top 5 Cryptocurrencies to Stake for Passive Income

Staking cryptocurrencies has become one of the best ways to earn passive income with your tokens.

Staking refers to cryptocurrency holders’ voluntary participation in validating blockchain transactions. This process involves verifying that the ledger accurately reflects all transactions in a PoS network.

The actual checking is conducted by computers that are part of the blockchain network, often using third-party staking services. In exchange for their validation efforts, validators receive a portion of the transaction fees or newly generated cryptocurrencies.

These rewards are subsequently passed on to customers of centralized exchanges who choose to stake their assets, with the validators unable to use their own cryptocurrencies in the validation process for a certain period.

In this article, we have compiled a list of the best cryptocurrencies you can safely stake for additional income. Let’s get into it.

(NOTE: the APY is variable and it changes over time)

Ethereum (ETH)

Ethereum is an open-source platform that allows developers to create and implement decentralized applications such as smart contracts and other complex legal and financial applications. The cryptocurrency with the second-largest market capitalization bears the same name; many even believe it will overtake Bitcoin (the “Flippening”). The ultimate goal of Ethereum is to create a digital future that can potentially empower all of humanity on a global scale.

On September 15, 2022, after the so-called “Merge,” Ethereum transitioned from PoW to PoS, which reduced the blockchain’s energy consumption by 99.5%.

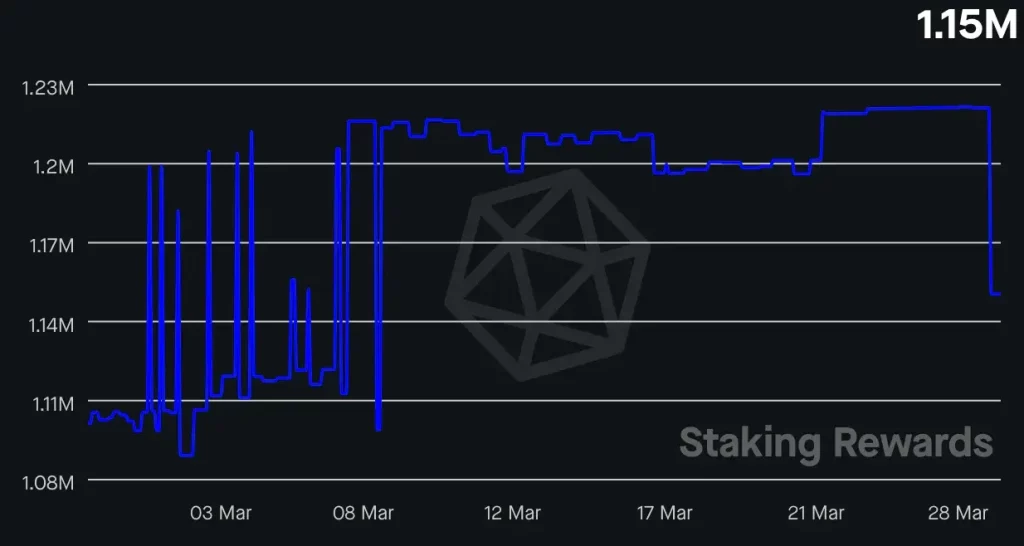

The staked ETH tokens will be unlocked after the Shanghai upgrade, which is scheduled for 2023.

ETH staking offers an APY of 3.9%.

Currently, $33.1 billion in ETH is staked out of the $210.5 billion market cap (around 15%).

At the time of writing, ETH is trading at $1,735 after a 4.6% drop in the week.

Cardano (ADA)

Cardano is an openly accessible and decentralized platform that utilizes a PoS consensus algorithm to foster the development of secure and adaptable smart contracts and decentralized applications.

With a research-driven methodology and scientific philosophy, Cardano is dedicated to addressing scalability and interoperability challenges.

RELATED: Cardano’s Voltaire Era: Empowering the Community for Decentralized Governance

Although the crypto community is far from agreeing on whether Cardano’s way is the most efficient, it is the platform’s main goal.

Cardano sets itself apart from other blockchain networks by subjecting its open-source blockchain to meticulous peer review by academic scientists and programmers.

With a current market cap of around $12.3 billion, 69% (or $8.6 billion) is dedicated to staking. ADA’s APY is 3.27%.

ADA is currently valued at $0.35 with no recent significant movements.

Solana (SOL)

Solana is a blockchain network that operates on the Proof-of-Stake consensus mechanism and incorporates a cutting-edge consensus algorithm known as Proof-of-History to enhance its scalability and security.

Founded by Anatoly Yakovenko in 2020, Solana is an open-source project currently run by a Geneva-based foundation, and Solana Labs built the blockchain itself.

Solana’s ultimate objective is to empower decentralized applications to accommodate millions of users. Unlike other scaling methods, Solana aims to boost its censorship resistance while increasing transaction processing capabilities tenfold through its high-performing nodes that mandate significant storage and ultra-low latency.

Solana is touted to be one of the fastest blockchains in the world and the fastest-growing ecosystem in cryptocurrency, with thousands of projects spanning DeFi, NFT, Web3, and more.

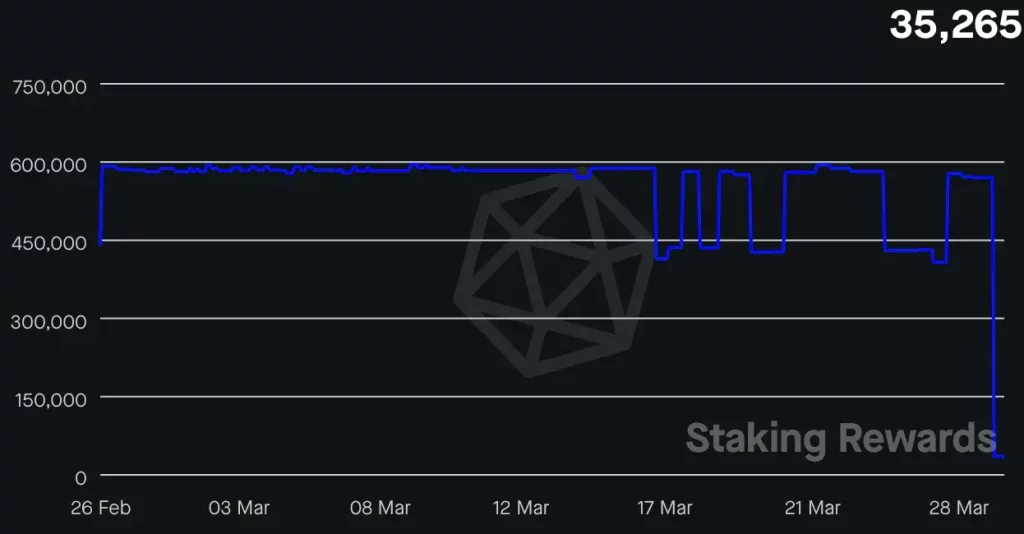

$5.5 billion of the total supply is being staked (out of $7.7 billion), around 71%. Staking SOL provides an APY of 6.6%.

At the time of writing, SOL is trading at $20 after a 13.5% decline on the weekly chart.

Polkadot (DOT)

The Polkadot network is a layer-0 protocol and multichain platform that was established by Gavin Wood, co-founder and former CTO of Ethereum. It serves a diverse range of layer-1 blockchains and their dApps, providing them with security, scalability, and interoperability. Polkadot stands out for its features, such as open governance, secure cross-chain interoperability, energy efficiency, and seamless upgradeability.

READ MORE: Elon Musk Shares Warning about the Banking Crisis – Bitcoin to become “Freedom Money”?

In other words, Polkadot is a protocol that connects blockchains and allows the sending of value and data across previously incompatible networks (e.g., Bitcoin and Ethereum). The network’s cryptocurrency, DOT, is used for stacking and management.

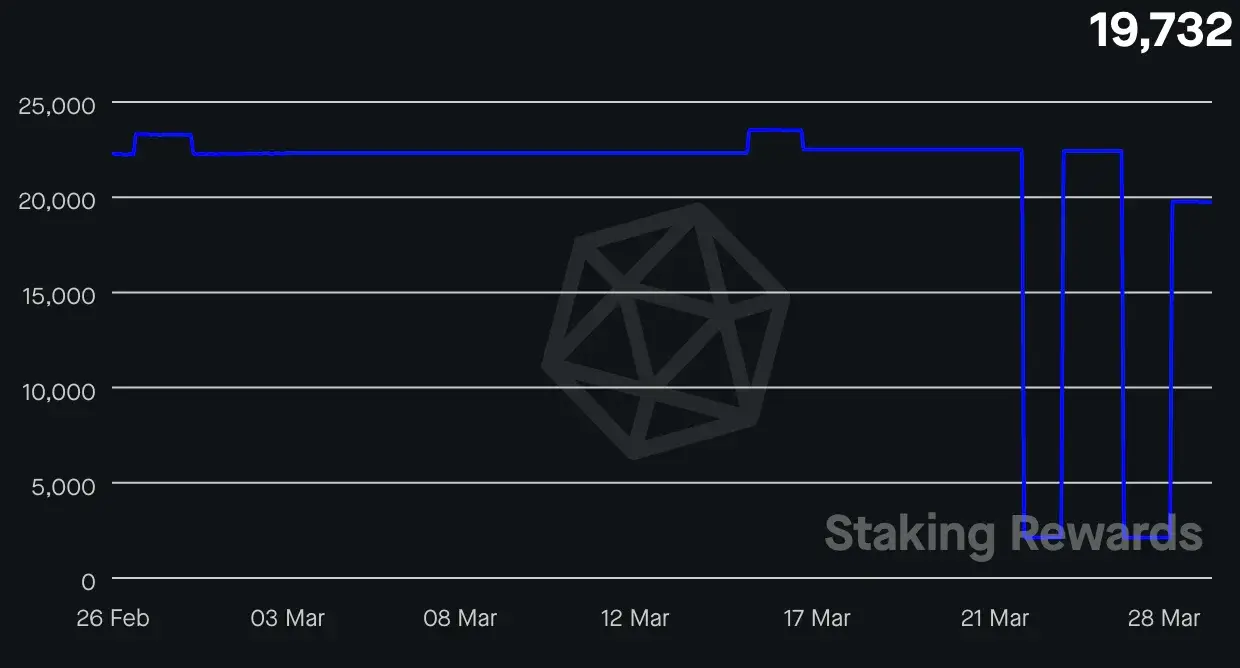

$3.6 billion (47%) in DOT of the total market cap of $7.2 billion is being staked. With an APY of around 14.35%, DOT is one of the best staking options in the market right now.

The altcoin is trading at $5.96 after a 5.75% decrease in the past week.

Polygon (MATIC)

Polygon is a scaling solution built on Layer 2 for Ethereum with the goal of enhancing scalability and usability while maintaining decentralization. Polygon utilizes the Plasma framework and the More Viable Plasma (MoreVP) consensus algorithm to achieve this objective, guaranteeing network security and integrity.

Additionally, Polygon enables interoperability with Ethereum, facilitating seamless asset transfer between both networks and aims to offer developers and users a more efficient and user-friendly blockchain platform.

With a market cap of almost $9.6 billion, around 40% (or $3.8 billion) is used for staking. MATIC’s APY for staking is close to 8%.

At the time of writing, MATIC is valued at $1.06 after a 8.9% price drop in the past 7 days.