Voyager Digital Sells Off Millions of Dollars Worth of Assets

According to new data, Voyager Digital, a bankrupt crypto lender, has recently sold off hundreds of billions of meme token Shiba Inu (SHIB) and other digital assets.

Blockchain-tracking platform Lookonchain reported that Voyager sold 400 billion SHIB, worth approximately $4.4 million, as part of its most recent sell-off. The firm also liquidated 27,255 Ethereum (ETH), valued at $42 million, 11 million Voyager Token (VGX), valued at $6.3 million, and 160,000 Chainlink (LINK), valued at $1 million.

1/ #Voyager keeps selling assets!#Voyager sold $56M worth of assets in the past 24 hours, including:

– 27,255 $ETH ($42M)

– 11M $VGX ($6.3M)

– 400B $SHIB ($4.4M)

– 160,000 $LINK ($1M)

…And received 33.7M $USDC from Wintermute Trading, Binance US and Coinbase. pic.twitter.com/kx6BwSg2jl

— Lookonchain (@lookonchain) March 9, 2023

These large sell-offs are part of a recent trend of Voyager selling off its assets. Lookonchain reports that the firm sold $56 million worth of assets in the past 24 hours alone. In addition to the SHIB sale, Voyager received 33,700,000 USD Coin (USDC) from Wintermute Trading, Binance US, and Coinbase.

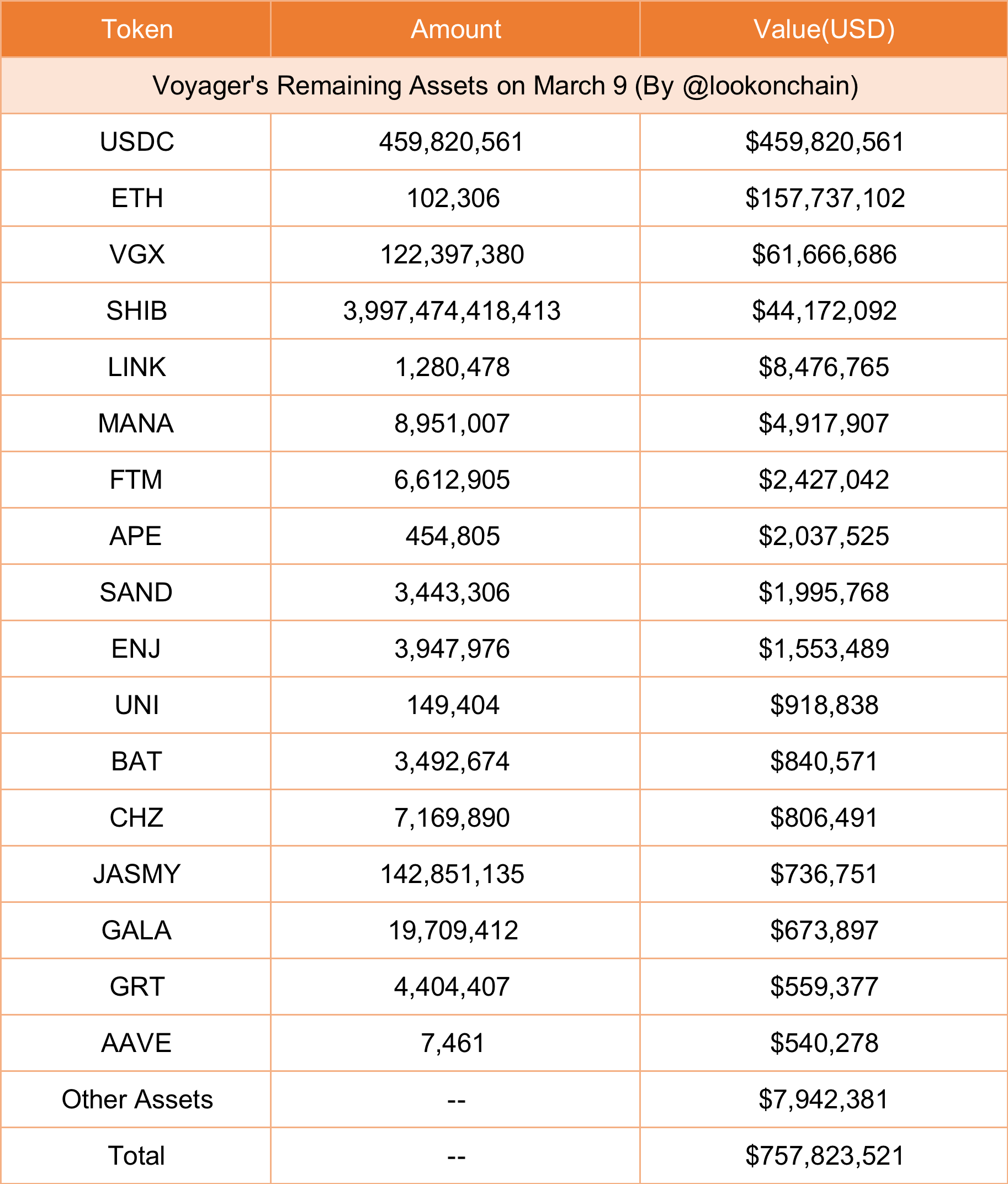

Despite these recent transactions, Voyager still holds а significant amount of digital assets. Lookonchain notes that Voyager currently has $757.8 million worth of assets, including 459.8 million USDC, 102,306 ETH (worth $157.7 million), 122.4 million VGX (worth $61.7 million), 4 trillion SHIB (worth $44.2 million), 1.28 million LINK (worth $8.5 million), 8.95 million MANA (worth $4.9 million), 6.6 million FTM (worth $2.4 million), 454,805 APE (worth $2 million), 3.44 million SAND (worth $2 million), and 3.9 million ENJ (worth $1.55 million).

This recent sell-off comes after Voyager was forced to shut down customer withdrawals and deposits in July 2021. The firm had given a loan worth hundreds of millions of dollars to crypto firm Three Arrows Capital, which could not repay it.

READ MORE: BaFin Considers Case-by-Case Approach for NFT Classification

Voyager eventually filed for bankruptcy and is currently selling its assets and transferring its customers to Binance.US. According to Reuters, the deal has not yet been finalized, but it cleared a significant hurdle after U.S. Bankruptcy Judge Michael Wiles approved it.

Voyager’s recent sell-offs and bankruptcy filing highlight the potential risks and volatility associated with investing in the crypto market. While digital assets have the potential to generate significant returns, they also come with a high level of risk due to their decentralized nature and lack of regulation. Investors need to do their due diligence and understand the potential risks before investing in any digital asset.