Wall Street Lowers Optimism Amid Slowing US Economy

Recent shifts in economic data have tempered Wall Street's optimism about the US economy.

Predictions are now being scaled back as signs of slowing activity emerge across various sectors.

Neil Dutta, head of economic research at Renaissance Macro, expressed his cautious outlook, stating, “Conditions are fine, but I would hardly describe the situation as consistent with a meaningful acceleration.”

Goldman Sachs, which has been bullish on the economy, revised its second-quarter GDP growth estimate down to 2.7% from 3.2%, citing weak spending momentum. Similarly, the Atlanta Fed’s GDPNow tracker dropped to 1.8% from over 4% earlier in May.

READ MORE: China Reduces U.S. Treasury Holdings by $101.9 Billion

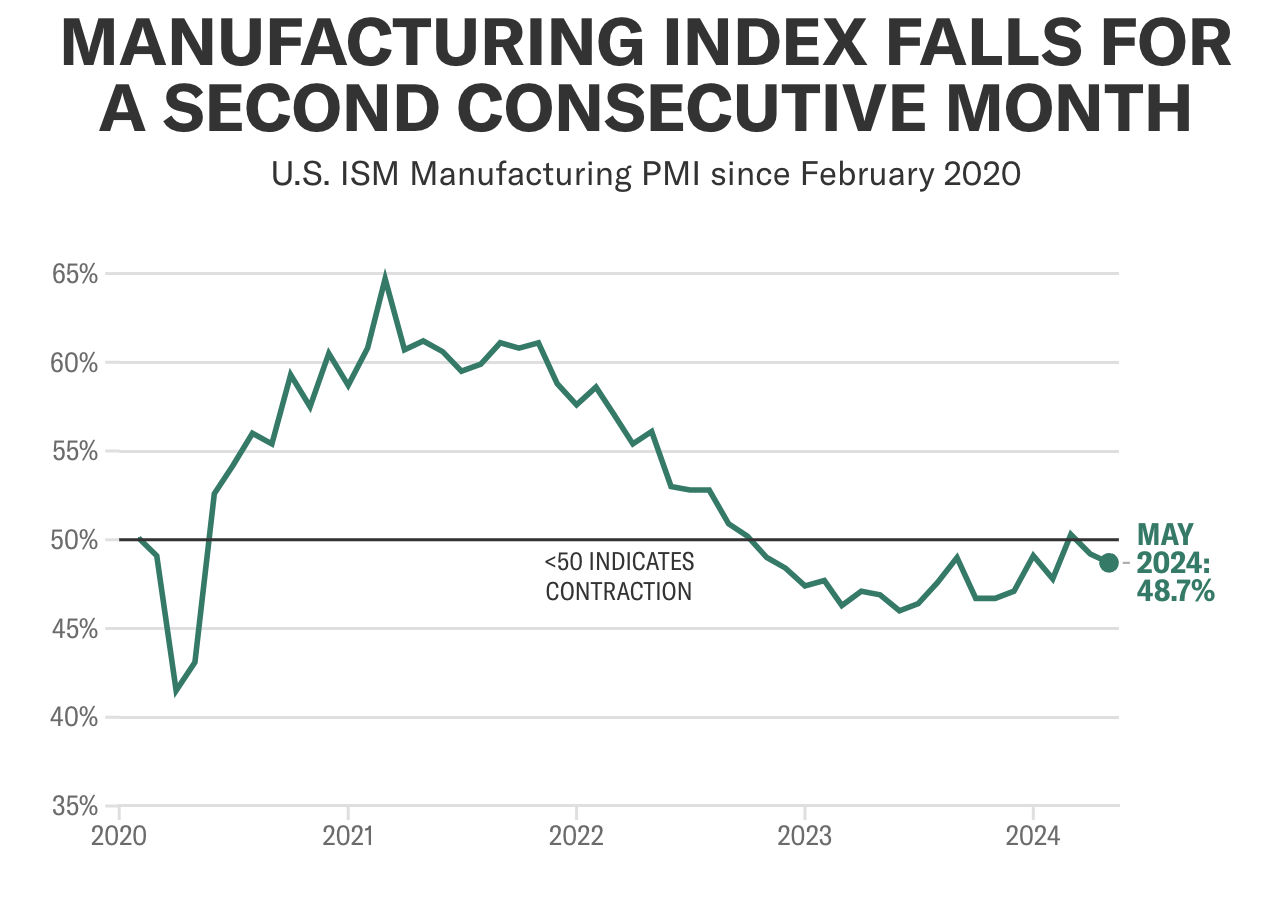

Adding to the concerns, the Institute for Supply Management (ISM) reported a decline in manufacturing activity, with the PMI falling to 48.7 in May. This was below expectations and marked the second consecutive month of contraction after briefly entering expansion territory in March.

Other economic indicators also pointed to a slowdown. The April jobs report showed weaker-than-expected job growth and a rise in the unemployment rate. Retail sales for April were softer than projected, and there was a decline in first-quarter economic growth driven by lower consumption.

Despite these signs, the stock market has remained resilient, with major indexes hitting record highs in May. The Citi Economic Surprise Index’s negative correlation with the S&P 500 indicates that investors are viewing weaker economic data as a potential trigger for Federal Reserve interest rate cuts, which could benefit stocks.

READ MORE: Tether Co-Founder Optimistic About China’s Crypto Acceptance

Bank of America’s equity strategist Ohsung Kwon noted that while the current data might support a favorable environment for stocks, a significant deterioration in economic growth could change this outlook. The upcoming May jobs report, expected to show 185,000 new jobs with unemployment steady at 3.9%, will be a crucial indicator.

Kwon suggested that if the labor market remains in a “Goldilocks” range—not too hot to spur inflation fears and not too cold to signal a slowdown—it could support further stock market gains.