Whale Activity Spikes for These Altcoins, According to Santiment

February 2023 marks a month of increased whale activity as the cryptocurrency market is steadily recovering from the 2022 downfall.

According to Santiment data, there has been an increased whale activity for Cardano (ADA), Paxos Standart (USDP), Hex (HEX), and The Sandbox (SAND).

Cardano

Cardano is a decentralized Proof-of-Stake (PoS) network that like Ethereum utilizes smart contracts.

The firm’s analysis reveals that Cardano has seen significant interest from whale addresses since February, with whale transactions defined as those larger than $100,000.

Despite a five-day gap in data, Santiment suggests that the asset has experienced a substantial spike indicating major interest from whales at this level.

ADA, Cardano’s native cryptocurrency, is currently valued at $0.39 and ranks as the seventh-largest crypto asset by market cap.

The altcoin registered a 3% decline in the past 24 hours and remains around 87%, down from its all-time high of $3.09 in September 2021.

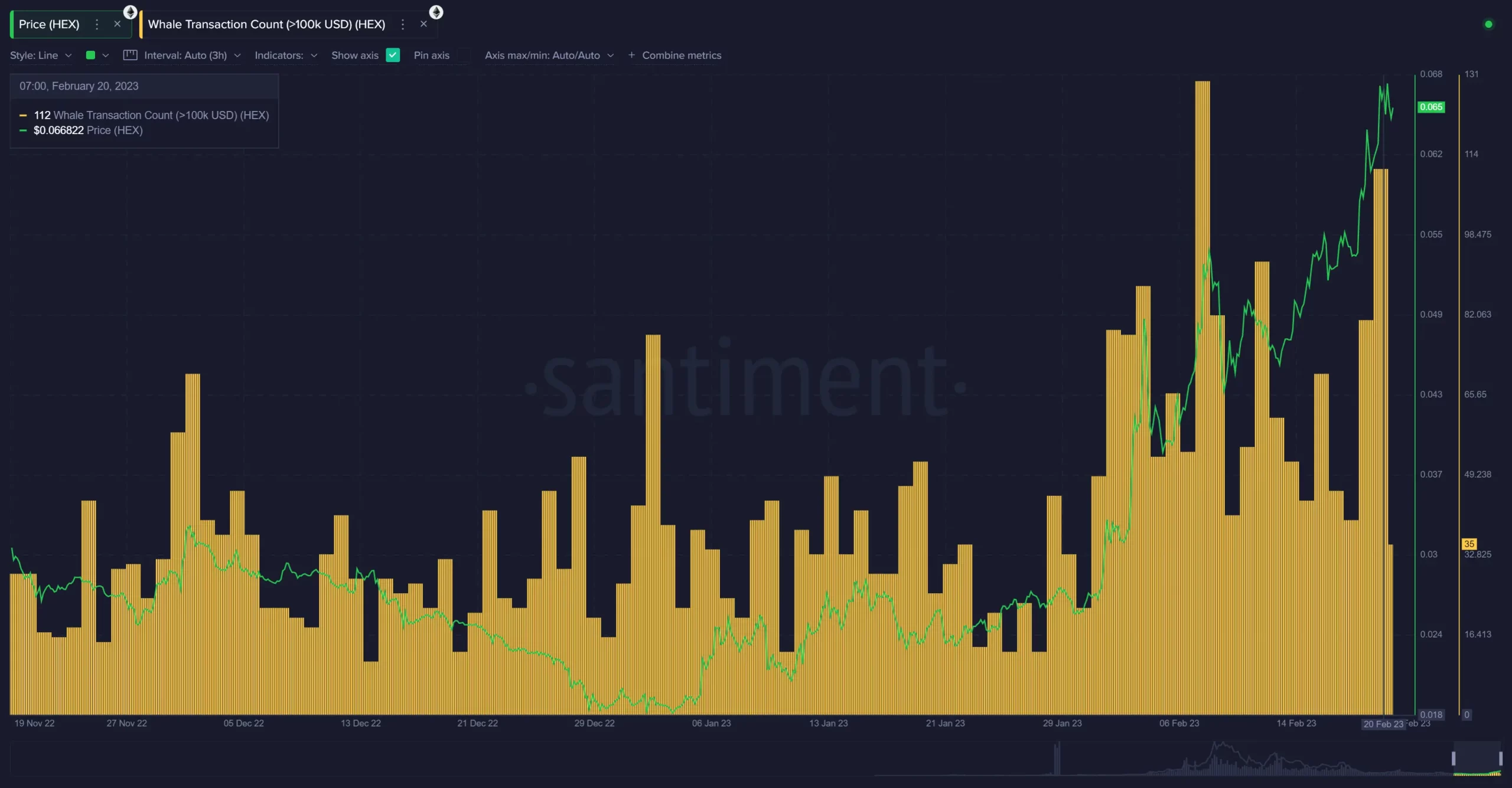

Hex

HEX is an Ethereum-based token that bills itself as the first blockchain certificate of deposit (CD). Instead of rewarding miners or validators who operate the network, Hex’s model compensates token holders with rewards.

The staking mechanism is designed in such a way that HEX tokens are burned when creating a new stake, and users are rewarded with “T-Shares.” The longer the stake, the more T-Shares are earned, and each share accumulates HEX interest daily.

At the time of writing HEX is trading at $0.05911 after a 10% decline in the past 24 hours.

According to Santiment data, on February 20 Hex witnessed the highest level of whale transactions other than February 9.

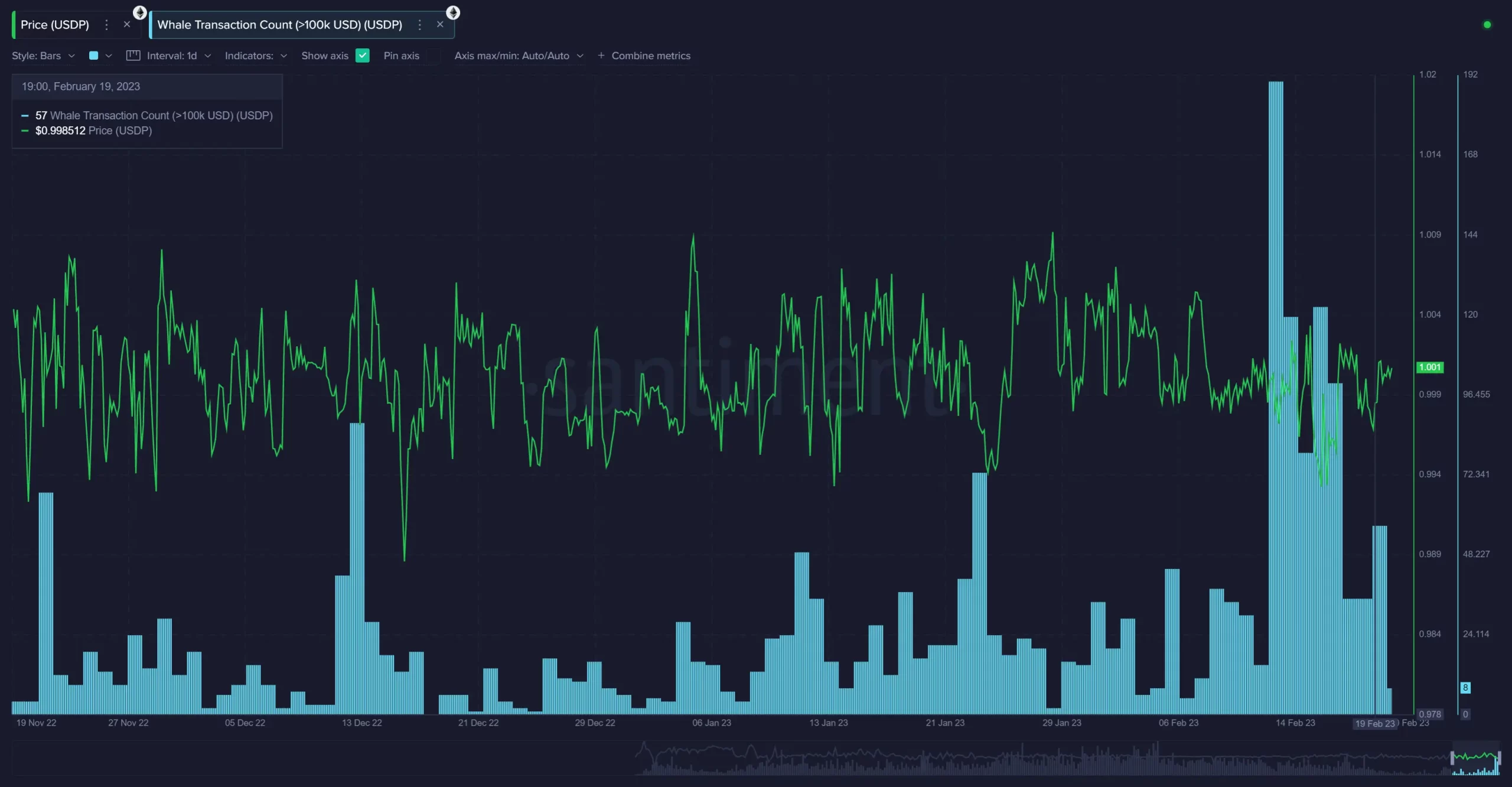

USDP

Pax Dollar (USDP) is a fiat-collateralized stablecoin created in 2018. It is currently ranked #58 according to CoinMarketCap data with a total market cap of $875.5 million.

The recent SEC lawsuit, which ruled their BUSD stablecoin as an unregistered security, might be the reason behind the increased activity in Paxos Standard.

The Sandbox

SAND is the native token for the metaverse blockchain project dubbed “The Sandbox.” It is an Ethereum-based ERC-20 token that serves as the network’s utility token.

The Sandbox experienced significant whale activity in past three months.

Santiment highlights that this uptick in whale activity coincided with a surge in SAND’s price, which increases the likelihood of a short-term correction.

READ MORE: Regulators Ignored Warnings of Fraud in the Cryptocurrency Industry

SAND, currently valued at $0.783 and ranked 43rd by market cap, has fallen over 3.5% in the past month and more than 6% in the past 24 hours. It remains more than 90% down from its all-time high of $8.40 in November 2021.