10 Reasons Why BRICS’s Currency Will Fail

The aim is to create a currency that can compete against the dominance of the US dollar. However, several key points suggest the new BRICS currency will likely fail. This article explores these points in detail.

Recent developments, such as China brokering a deal between Saudi Arabia and Iran, demonstrate the increasing interest of emerging economies in joining BRICS.

If enough countries switch from the USD to the new BRICS currency, it could flood the global market with unwanted dollars, leading to massive inflation and a decrease in the value of bank accounts.

This scenario could potentially trigger a collapse in the US economy.

Despite the potential emergence of a new BRICS currency, the USD will likely continue to be widely used.

Comparative Decisions

When it comes to currency decisions, individuals and bankers tend to compare currencies and choose the one that appears better than other alternatives.

Given the widespread use and stability of the USD, people are more likely to prefer keeping their money in USD rather than a new and untested currency like the BRICS currency.

READ MORE: Race Against Default: Biden and McCarthy at Odds Over Debt Ceiling

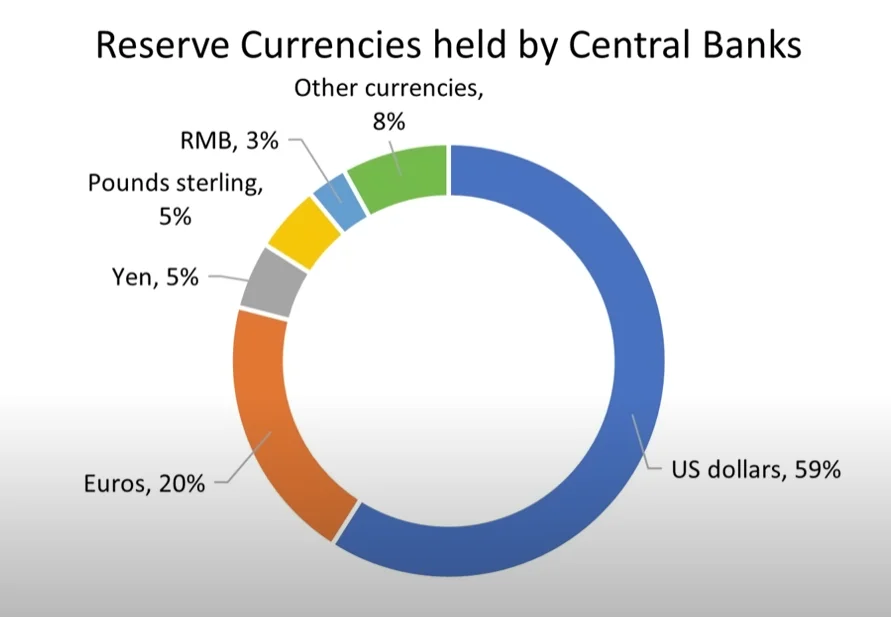

Currently, 59% of global bank reserves are held in USD, over 60% of world debt is issued in USD, and nearly 90% of global currency transactions involve the USD.

Moreover, 74% of trade in the Asia-Pacific region and 96% in the Americas utilize the USD. The global economy relies heavily on the USD, making it a more attractive option than a new and untested currency.

Floating Currencies vs. Commodities

One common complaint about the USD is that it is no longer backed by gold. According to most, this is a bad thing.

However, there is another side to this argument – tying a currency to a commodity like gold has its downsides.

Commodities are volatile and prone to fluctuations, which can adversely affect the value of a currency and lead to inflation. This includes gold.

And while it may not be highly volatile, price swings do happen, which is not good for a currency.

The Federal Reserve (FED) manages the USD, which sets interest rates to control inflation and manages the currency.

The Performance of the Federal Reserve

Although the FED may not always perform flawlessly, it does not necessarily warrant a change in the system but rather a change in the people managing it.

The FED has a track record of managing various economic crises and has historically performed better than past alternatives.

The Strength of the US Economy

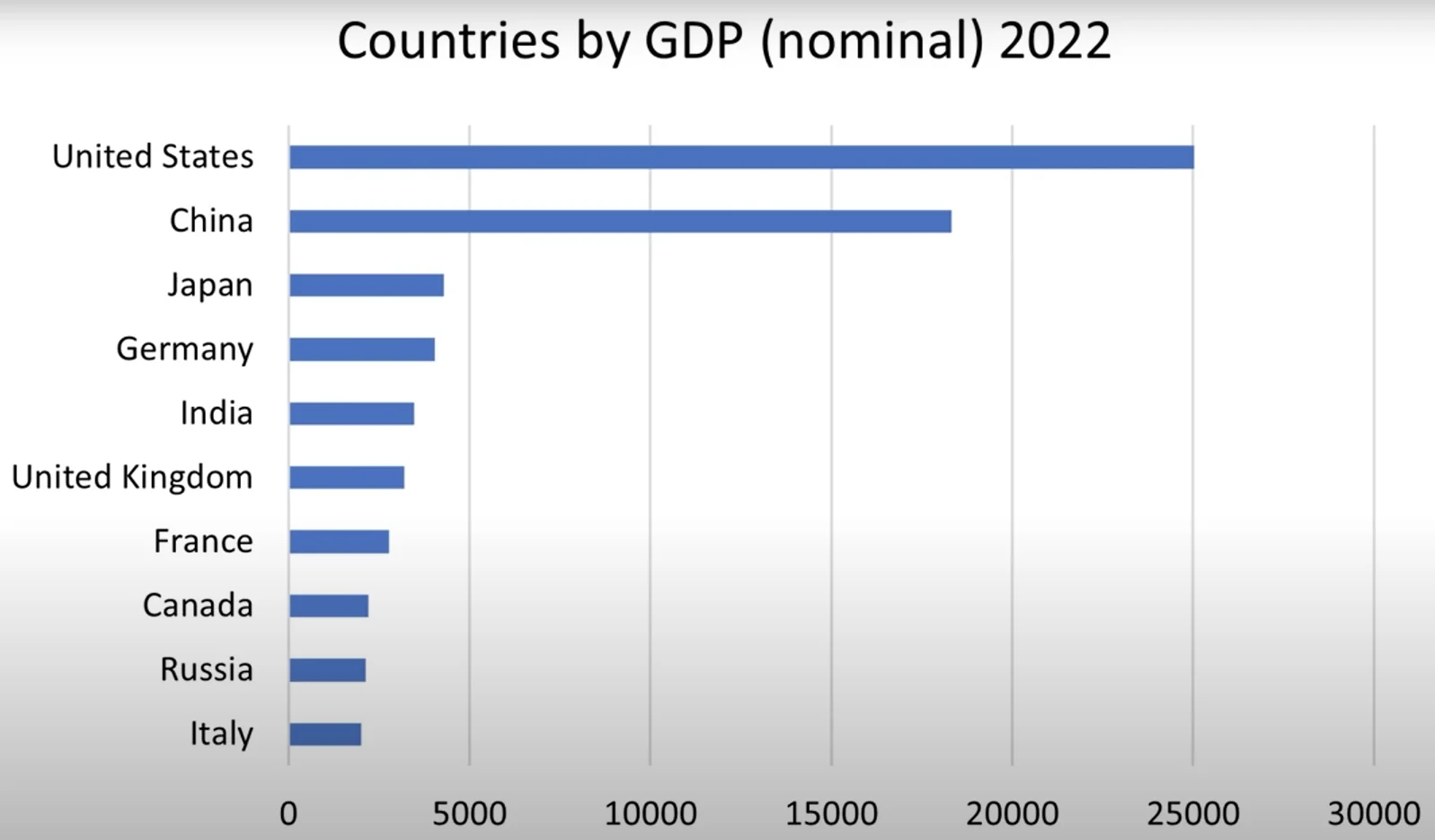

The US economy is the largest globally, with only China coming close in terms of GDP, as per IMF data.

Comparisons are often made between the US GDP and the combined GDP of BRICS nations, but it’s essential to question the reliability of China’s statistics, especially considering its heavy reliance on the real estate market, which is currently experiencing a downturn.

The USD is backed by real economic activity, and if problems arise, the US has the option to increase taxation or reduce government spending to maintain stability.

Lessons from the Euro’s Failure

The experience of the Euro serves as a cautionary example for the BRICS currency. The Euro attempted to challenge the USD but ultimately failed. Despite having a larger combined GDP than the US, the Euro accounts for only 20% of world reserve currencies central banks hold.

The difficulty in coordinating financial policies among multiple countries with different priorities and struggles for bankers make it challenging for the Euro to compete effectively.

READ MORE: Dollar’s Reign Nears its End: Investor Jim Rogers Predicts Global Currency Shift

Instability among BRICS Nations

The BRICS nations themselves face internal conflicts and tensions. For instance, India and China have ongoing border disputes, while countries like Saudi Arabia and Iran, which have expressed interest in joining BRICS, have a history of animosity.

Such conflicts can destabilize a currency and create an environment of uncertainty and distrust among member nations, making it challenging for a new BRICS currency to gain widespread acceptance and stability.

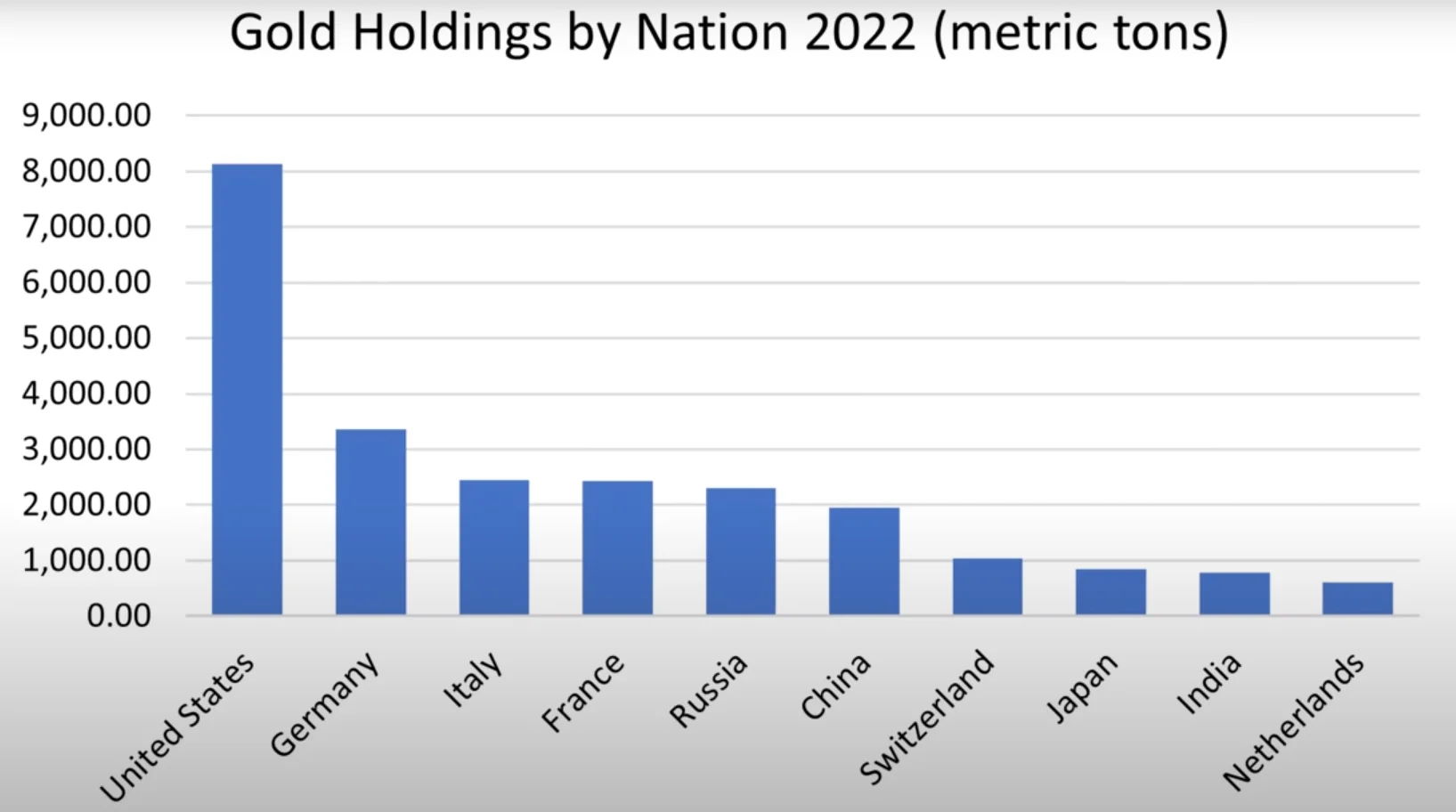

The USA has a lot of gold

Although the USD is not backed by gold in the traditional sense, the presence of a substantial gold reserve provides confidence and stability to the US financial system. The United States holds the largest gold reserves in the world, with over 8,000 metric tons, far surpassing other nations.

In comparison, China, often considered a key competitor to the US, ranks sixth with 1,988 metric tons.

Possessing a significant amount of gold gives the US an advantage in times of economic uncertainty. In the event of financial troubles or a loss of confidence in the USD, the US can revert back to the gold standard, where the currency’s value is directly tied to gold.

This historical precedent allows for a sense of reassurance among investors and provides an alternative mechanism to stabilize the economy if necessary.

Gold has long been viewed as a safe haven asset due to its scarcity and universal acceptance. The presence of a substantial gold reserve indicates that the US has tangible assets that can be relied upon to maintain the value of its currency.

This confidence in the US financial system is crucial for international investors and strengthens the USD’s position as the preferred reserve currency globally.

China’s Reputation in Currency Management

China has a reputation for manipulating its own currency to gain a competitive advantage in international trade.

Their main strategy has been to make Chinese goods appear cheaper by intentionally devaluing their currency.

With China being a major player in the BRICS group, there is a valid concern about whether they would attempt to manipulate the new BRICS currency as well, further undermining its credibility and stability.

Communism and Entrepreneurship

One of the fundamental challenges of the BRICS nations is China’s communist system. Communism is known to disincentivize entrepreneurship and restrict economic growth.

Capitalism, on the other hand, is known for generating wealth through entrepreneurship.

The limitations imposed by a communist system could hinder the economic growth and development necessary to support a successful new currency.

The Potential for Solving Issues in the US

While the United States is far from perfect, its system has the potential for improvement and problem-solving. With the right decisions and leadership, addressing any shortcomings and maintaining the USD’s position as the most widely used currency is possible.

READ MORE: High-Profile Crypto Names Caught in Crosshairs of Russian Sanctions

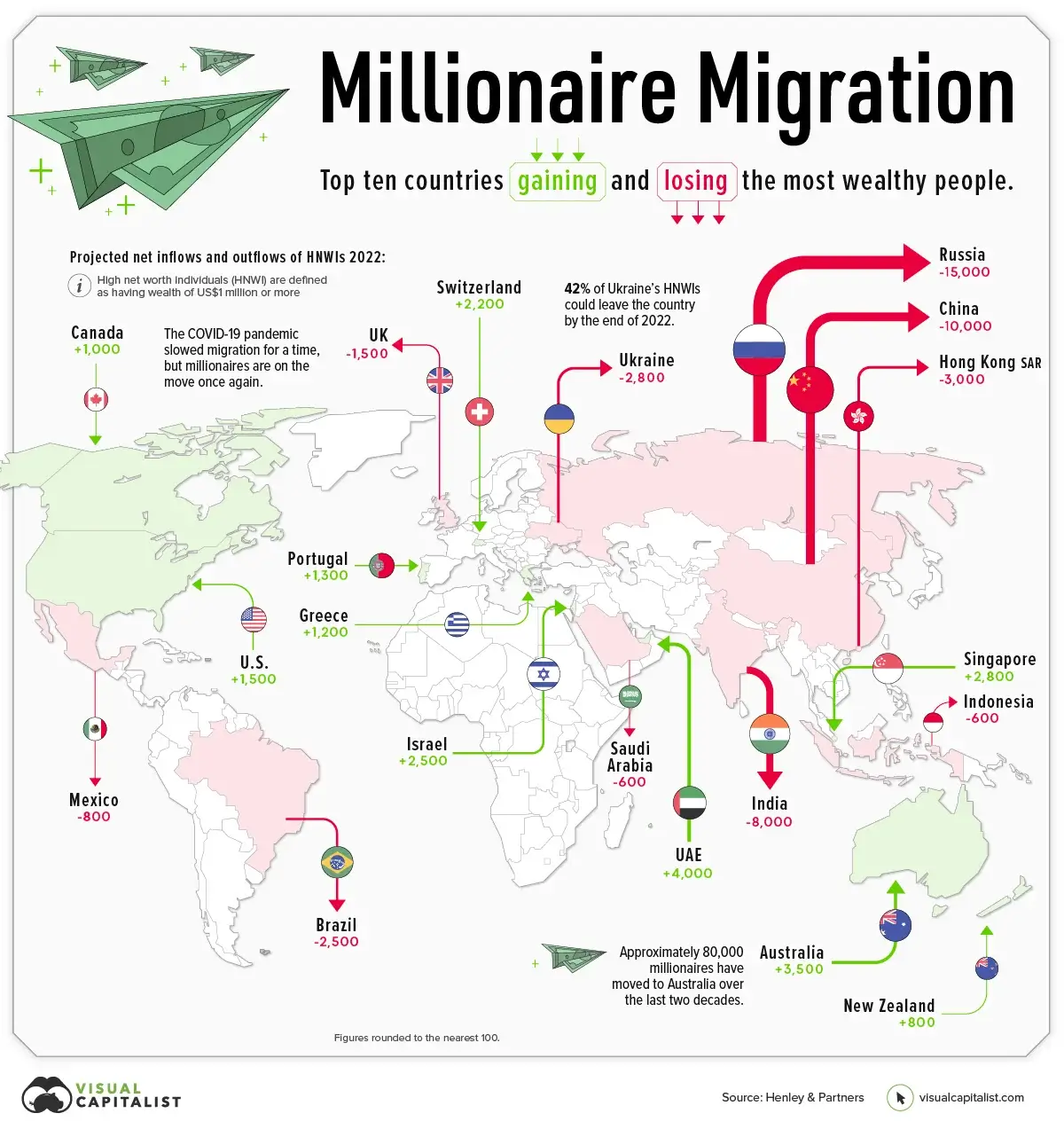

Notably, high-net-worth individuals continue to move their wealth to the US, a testament to the confidence in the country’s economic stability.

BRICS countries, on the other hand, have struggled to attract big-money players (with a net worth of over $1 million).

Conclusion

In conclusion, despite the growing interest in a new BRICS currency, all these key points indicate its likely failure.

The continued dominance of the USD, the stability and attractiveness of the US economy, the challenges of coordinating policies among multiple nations, internal conflicts among BRICS nations, concerns about China’s currency management, and the limitations imposed by communist systems all pose significant hurdles for the success of a new BRICS currency.

While the current US system may not be perfect, it can be improved upon, and the right decisions and leadership can maintain the USD’s position as the most widely used currency in the world.