Bitcoin: Is the Market Overbought or Just Getting Started?

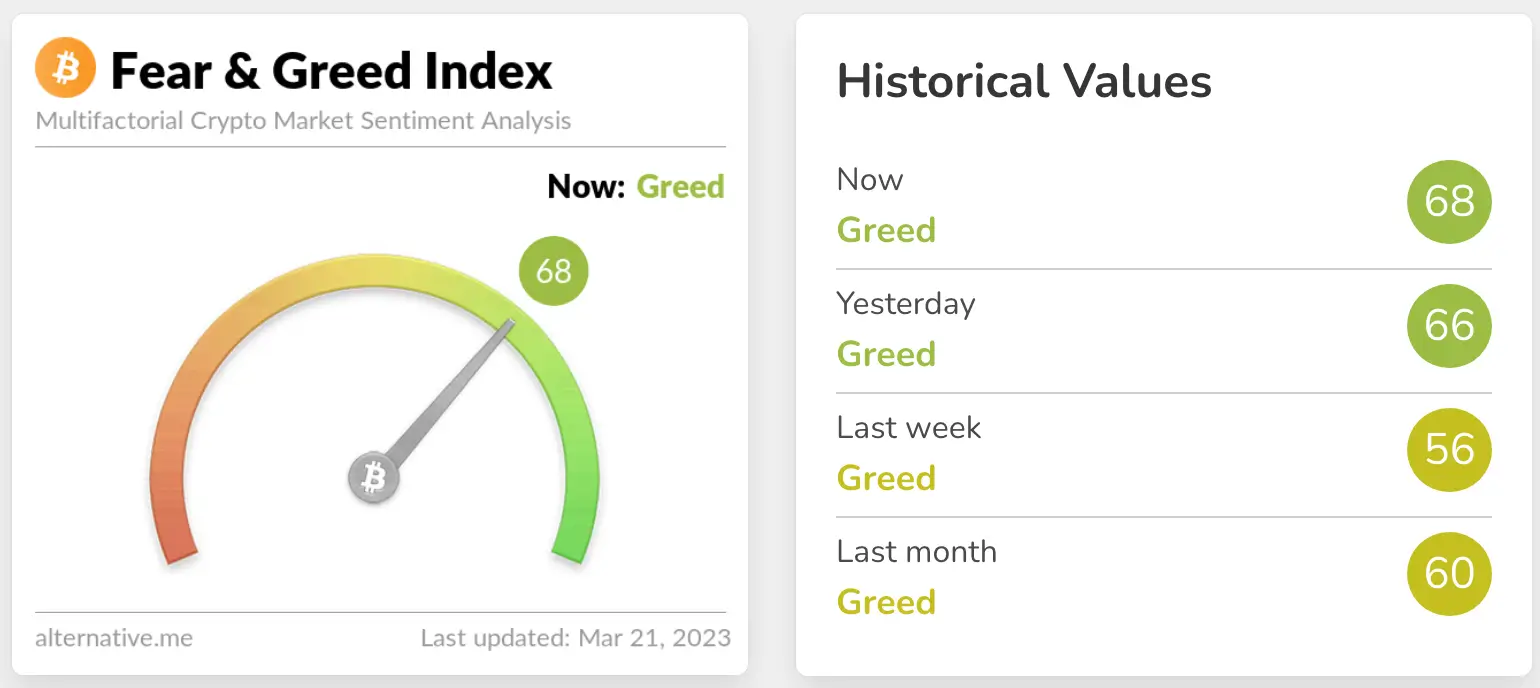

The Crypto Fear and Greed Index, a tool to measure market sentiment towards cryptocurrencies, has risen to a new high, which hasn't been seen since November 2021 - when Bitcoin reached $69,000.

The index shows growing optimism and confidence among investors as BTC surpasses $28,000. This increase in the index implies that traders are feeling more optimistic about the cryptocurrency markets’ future, despite recent regulatory concerns and market volatility.

Bitcoin’s value has surged significantly, with its price rising almost 30% and reaching $28,500 in just one week. Currently, BTC is trading at $28,122, a 16.3% increase over the past seven days, according to data from crypto market tracker Coingecko.

The current index is indicating a state of “Greed” with a score of 68 – a level that was last observed in November 2021, shortly after Bitcoin reached an ATH of over $69,000.

Experts warn that when the Crypto Fear and Greed Index reaches a high level, it may suggest that the market is overbought and may require correction. They may also advise investors that excessive optimism in investor sentiment could result in a market bubble and a consequent price crash.

Investors should conduct thorough research and consider various factors before making any investment decisions.

READ MORE: Arbitrum’s DEX Transactions Skyrocket to Record-Breaking Highs

According to recent data from Goldman Sachs, Bitcoin has outperformed traditional investment assets and sectors regarding absolute returns and risk-adjusted performance.

The reason for the rise in Bitcoin’s price is believed to be the growing likelihood of the US Federal Reserve changing its monetary policy. Despite warnings from analysts of a possible correction, the cryptocurrency has bounced back even stronger than Wall Street stocks, making it an appealing investment choice for many investors.