Bitcoin: PlanB’s Latest Model Predicts Bull Market Surge in 2023

The Stock-to-Flow (S2F) model, which gained popularity through analyst PlanB, has been both highly praised and heavily criticized.

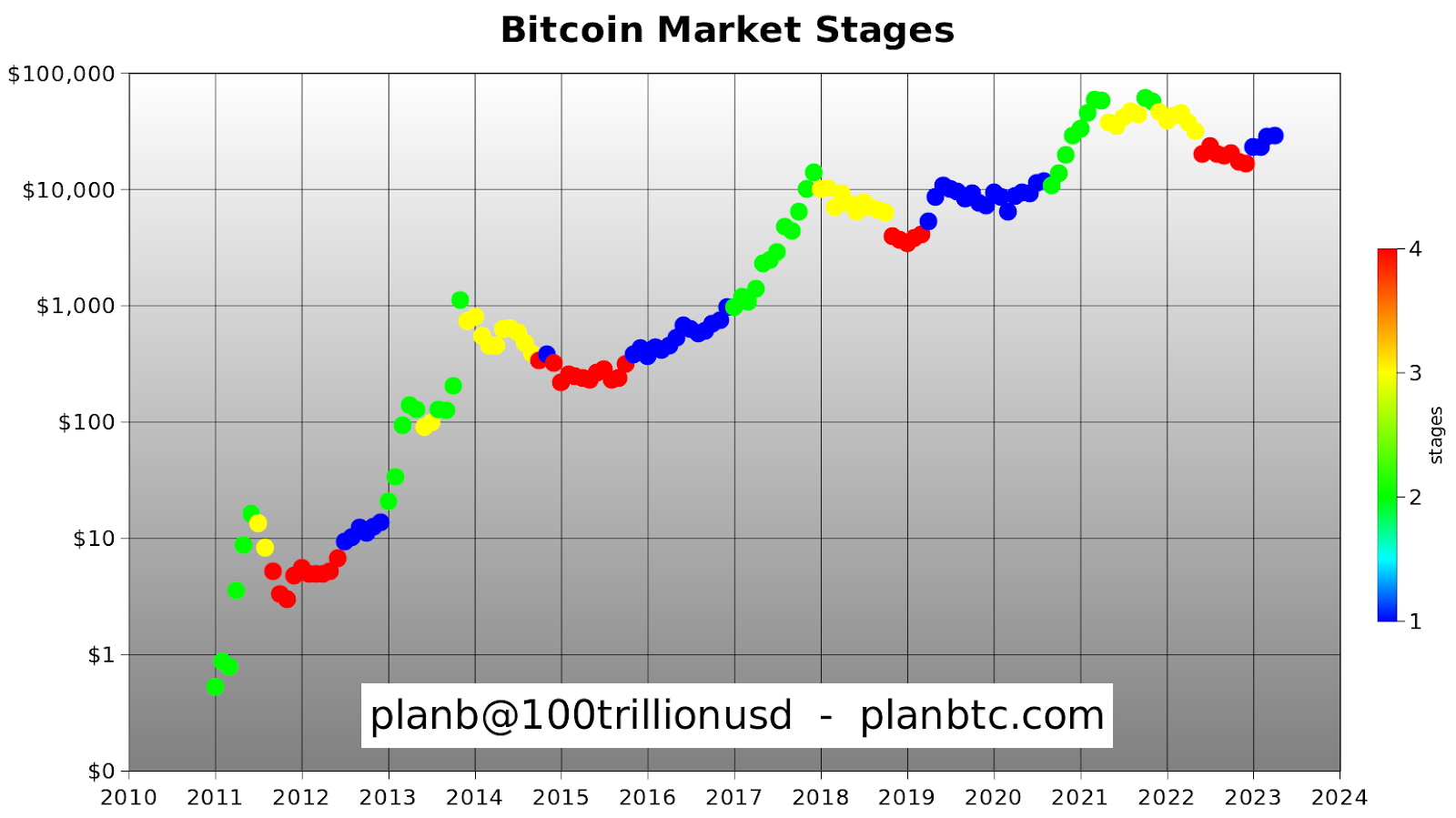

Recently, PlanB released a new long-term chart called Bitcoin Market Stages, which suggests that Bitcoin has entered a new bull market as of early 2023.

The chart is based on one on-chain variable, but PlanB does not reveal which one. Unlike S2F, Bitcoin Market Stages is not a predictive or valuation model; instead, it is designed to estimate which stage of the market cycle Bitcoin is in.

PlanB’s new model has four stages: early bull market (blue), late bull market (green), early bear market (yellow), and late bear market (red).

According to the chart, the late bear market phase ended at the end of 2022, indicating that Bitcoin is now in an early bull market.

PlanB has also provided an update on the S2F model based on historical halvings.

The model estimates that Bitcoin’s current price is $55,000 and predicts that the average price of BTC in the current cycle will be $100,000 or as much as $288,000, depending on the version of the model used.

READ MORE: Bitcoin: Bullish Metrics and New Pricing Model Suggest Positive Future

PlanB believes that the Stock-to-Flow Cross Asset Model (S2FX) is the most valuable model but admits that the original S2F model is currently the most accurate.

He predicts that Bitcoin will surge 100% by 2024, approaching the $55,000 – $60,000 range.

This would mean an average monthly increase of $2,500 for the cryptocurrency, assuming the next halving occurs on April 5.