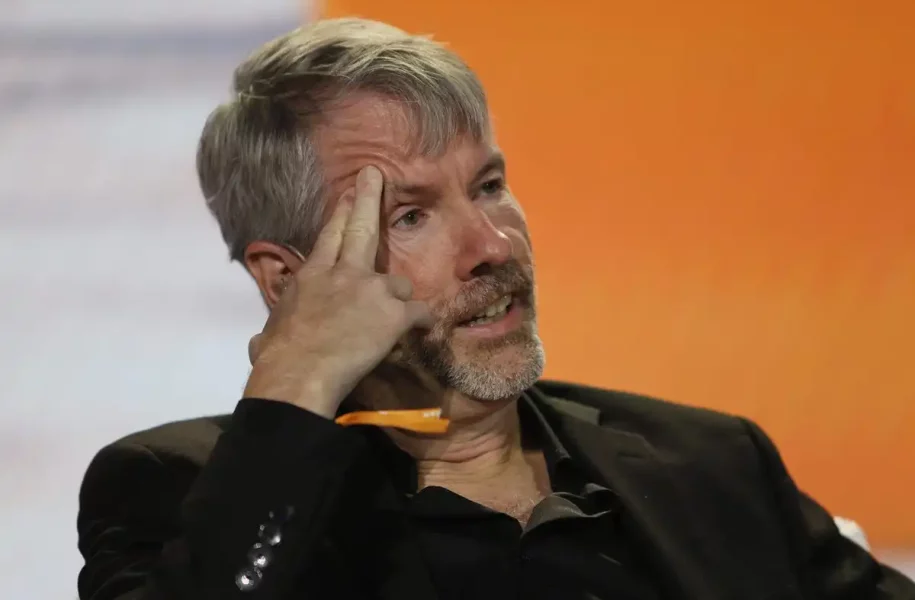

Court Dismisses Case Against Bitcoin Bull Michael Saylor

A new filing with the US Securities and Exchange Commission (SEC) revealed that a court has ruled in favor of Michael Saylor in a civil lawsuit against him.

The SEC documents show that in August of last year, the Office of the Attorney General for the District of Columbia filed a civil complaint against Saylor, accusing him of violating the False Claims Act and not paying personal income taxes amounting to over $25 million.

The complaint also names MicroStrategy as a defendant, alleging that the largest corporate owner of Bitcoin conspired with Saylor to assist him in evading tax payments. However, the SEC filing shows that in a February 28 ruling, the court threw out the charge that both MicroStrategy and Michael Saylor violated the False Claims Act.

The court ruled on the defendant’s motion to dismiss the complaint, dismissing the sole claim against MicroStrategy, which alleged that Saylor and the company conspired to violate the False Claims Act and a claim against Saylor, alleging that he violated the Act. However, the charge accusing Saylor of committing tax fraud still stands.

The court did not dismiss claims against Saylor, alleging that he failed to pay personal income taxes, interest, and penalties due. The final outcome of this matter is not presently determinable. A status conference in the case is scheduled for March 10, 2023.

In the meantime, the ruling is being seen as a victory for Saylor, a vocal proponent of Bitcoin and using MicroStrategy to invest in the cryptocurrency. Saylor has been praised for his foresight in investing in Bitcoin and has become a prominent figure in the crypto world. His success in the lawsuit is expected to boost his reputation even further.

READ MORE: Lawsuit Filed Against Gemini and BlockFi

The case highlights the challenges regulators face in trying to keep up with the fast-changing world of cryptocurrency. With new technologies and business models emerging constantly, it can be difficult for regulators to keep pace and ensure that individuals and companies operate within the law.

The ruling is also expected to have broader implications for the cryptocurrency industry as a whole. With more and more companies and individuals investing in Bitcoin and other cryptocurrencies, there is growing concern about how these assets will be taxed and regulated. The outcome of Saylor’s case could help to shape the regulatory landscape for years to come.