The Dark Side of Crypto: How Criminals are Laundering Billions in Illicit Funds

Undoubtedly illegal conversion of proceeds from criminal activities into legitimate funds money has become a lot easier with the advent of cryptocurrencies.

Criminals are increasingly turning to crypto for money laundering as cryptocurrencies possess two characteristics that make them attractive. The decentralized nature of cryptocurrencies allows for a certain degree of anonymity, making it more difficult for law enforcement agencies to track transactions.

Also, the convenience of cross-border transfers is useful for those looking to move significant amounts of money quickly and discreetly.

Money laundering in 2022

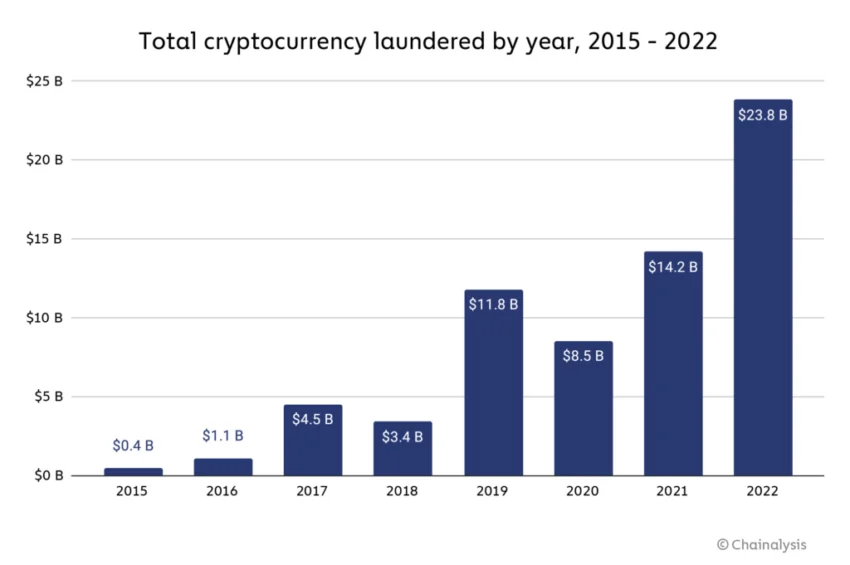

According to Chainalysis, 2022 was the biggest year yet for crypto money laundering, with illicit addresses transferring about $23.8 billion in cryptocurrency, a 68.0% rise from 2021.

Mainstream centralized exchanges received almost half of the total illegal funds, despite having compliance measures to report suspicious activity and take action against offenders. Recent findings from Elliptic indicate that RenBridge has laundered at least $540 million in cryptocurrency linked to criminal activity since 2020, with $153 million associated with ransomware payments.

Cryptocurrency has been a popular way to launder money for criminal organizations since the mid-2010s, according to Martin Cheek, the managing director of SmartSearch. As regulators have scrutinized cryptocurrencies, their use for money laundering has become more difficult.

Tightening regulations

However, criminals continue to find new ways to use crypto for money laundering, making it a challenge for law enforcement agencies and financial regulators to detect and prevent money laundering in the crypto space.

READ MORE: Bitcoin: How far can the Asset go in the Next Bull Run?

Earlier this year, Britain’s Financial Conduct Authority (FCA) failed to pass 85% of all crypto firms applying for registration due to a lack of expertise and internal process related to anti-money laundering and anti-terrorism rules. In a few cases, the FCA identified possible financial crimes or direct links to organized crime and notified law enforcement agencies of suspected cases.

Decentralized exchanges, which offer a higher level of anonymity, are increasingly being used to “clean” dirty cash, and smaller exchanges aren’t doing nearly enough to prevent money laundering on the scale that is needed.

Law enforcement agencies, such as Britain’s National Crime Agency, are closing in on crypto money laundering and using better crypto knowledge and blockchain analysis tools to catch criminal activity. Although crypto assets are more frequently reported as an enabler of serious and organized crime, the volume of crypto-related money laundering is still low compared to the broader economy.