Warren Buffett’s Portfolio Takes a Hit as Banking Crisis Sweeps the Market

Most investors in the S&P 500 are losing money due to the banking crisis, and even Warren Buffett is not immune.

Buffett’s love for financials has backfired, as six of his 15 worst-performing stocks this year are in the financial sector.

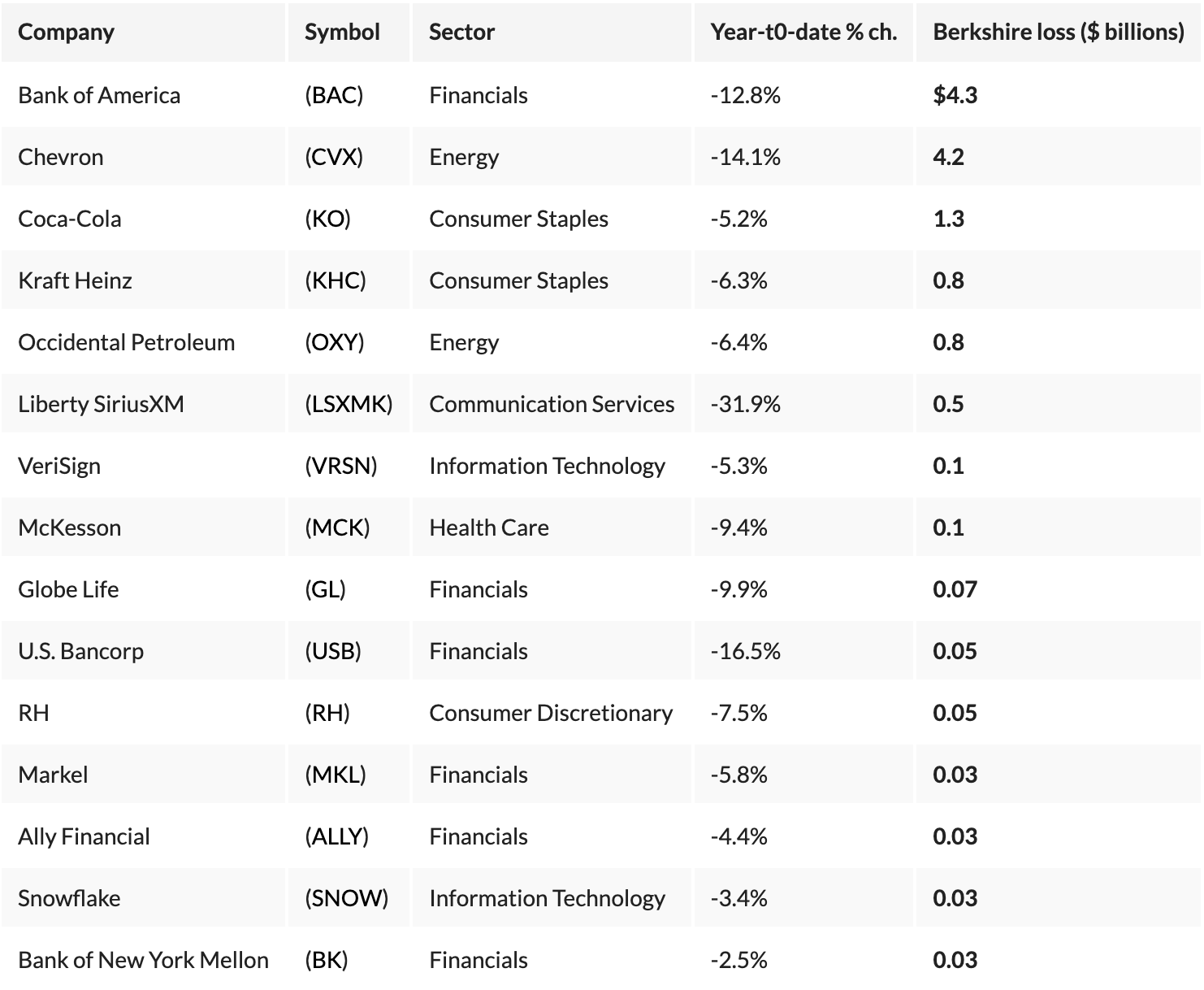

According to an analysis by Investor’s Business Daily, Berkshire Hathaway has suffered a loss of $12.8 billion on its 15 worst-performing US-listed stocks this year, with financials such as Bank of America, Ally Financial, Bank of New York Mellon, and U.S. Bancorp causing the most trouble.

The market value of banks worldwide has fallen by over $500 billion in the past week and a half, marking a historic decline.

Berkshire Hathaway is a large owner of some of these banks, including Bank of America, down 12.8% this year, causing Berkshire Hathaway a loss of over $4 billion.

However, Berkshire Hathaway has been reducing its position in some banks, such as U.S. Bancorp and Bank of New York Mellon, which has mitigated its losses on these stocks.

The stock is down nearly 17% this year, erasing nearly $48 million off Berkshire Hathaway’s remaining position.

Berkshire Hathaway still owns nearly 10% of Ally Financial, which has a large auto loan business, but the stock is down 4.4%, resulting in a loss of $31 million in value this year.

In addition to financials, Berkshire Hathaway is also experiencing losses in the oil giant Chevron, in which it has an 8.8% stake. Falling oil prices have caused Chevron’s value to drop 14.1% this year, resulting in a loss of over $5 billion for Berkshire Hathaway.

Overall, the banking crisis has had a significant impact on Berkshire Hathaway’s portfolio, resulting in losses of billions of dollars. While the holding conglomerate has been reducing its position in some of these companies, its large ownership in Bank of America remains a major cause of concern.